Card payments are increasing all the time. Just think about how often you use your card rather than cash. According to the UK Payment Markets August 2022 report, approximately 57% of all payment transactions recorded in the UK were taken by card. This number has been increasing steadily year on year.

So if you run a business and don’t yet accept card payments, why not? Fortunately, it’s never been easier to learn how to accept debit or credit card payments — even for small businesses.

And while we are a business that offers our own online payments service to help businesses take card payments online — this article will look more broadly at the questions businesses looking to accept card payments often ask, along with how they can get the best service for their needs in the wider industry.

It used to be that card payments were slow and awkward for businesses to process — requiring signatures, unreliable technology and long processing times, but thankfully not anymore. Today, the payment process is quick and simple both for online businesses and in-store.

For example, a business’s website can accept card payments via an online payment gateway. Whereas in-store, quick and easy payment examples include:

If someone calls up your business and wants to make a payment, you can even take card payments over the phone by using a virtual terminal.

Because it’s so easy, customers love paying by card. It’s now common for most people to make a purchase with either a credit or debit card. And a lot of younger people almost never have physical money on them anymore!

The great thing about taking credit or debit card payments is that there are a number of payment options to suit every type of business.

Whether it’s accepting online payments or taking card payments in person with Chip and PIN or contactless payments, the right payment method for your business will depend on things like your business functionality and its size. However, there are a couple of things that all businesses will have in common; if you’re accepting card payments you will need a payment gateway and a merchant account.

And of course if your business model does a blend of all of these things, then you can manage all of your card payment processing services together in one integrated payment solution.

As a business owner, you can benefit a lot from integrated payment solutions, if you aren’t already taking advantage of them.

A good integrated payment solution will help you manage your payment services better by helping you to:

They can do this by connecting your payment processing services to other parts of your business, including your payroll, CRM and accounting software.

So for example, whenever a payment is processed by your service provider, the data is automatically accounted for and recorded without you having to do anything.

Integrated payment systems make a more streamlined experience both for you and your customers. A good solution can also be integrated into the card readers that you use, so they are handy for in-person transactions too. It’s never too late to switch to an integrated solution, and you should see the difference almost immediately.

If you don’t yet have an integrated payment solution, you’re likely already familiar with the more traditional payment solutions and how they can be enormously time consuming.

For example, traditional solutions often involve the manual counting and collecting of invoices, receipts and credit/debit card information. Not only is this a lengthy and error-prone process, but businesses often lose out by paying accountants to do the work for them.

With an integrated payment scheme, all of this tedious work is performed by algorithms in real time. Leaving you with more time as a business owner to work on developing your business.

You should know that accepting card payments, even if you implement a quick and easier payment process into your business, does come with potential fraud and security risks. However, as long as you’re aware of these risks and put the right security measures in place, the benefits will far outweigh the potential negatives.

However, if your business doesn’t accept any card payments at all yet, then by switching over you’ll reduce the risk of having to hold significant amounts of cash on your premises, which can be an easy target for theft.

To protect your business from card fraud, a number of 3D Secure authentication tools are available that can be integrated alongside any other security your site has.

These include:

In addition, when taking payments online your business and customers will benefit from the payment system being PCI compliant.

PCI compliance is the security standard endorsed by credit and debit card companies, such as Visa and Mastercard, and ensures you have the right controls in place to protect yourself and your customers when they pay.

Read more about how our fraud and risk management tools can protect your business.

For more information on fraud prevention and security when it comes to accepting card payments, click on these links here:

No two businesses operate in quite the same way, and so there is no “one size fits all” glove when it comes to accepting card payments (at least if you want to really optimise how you accept and process card transactions that is).

So, if you’re interested in an integrated payment solution, and want to get the best results possible, you’ll want a provider that can offer customisable solutions and who can really work with you to get the most out of your business.

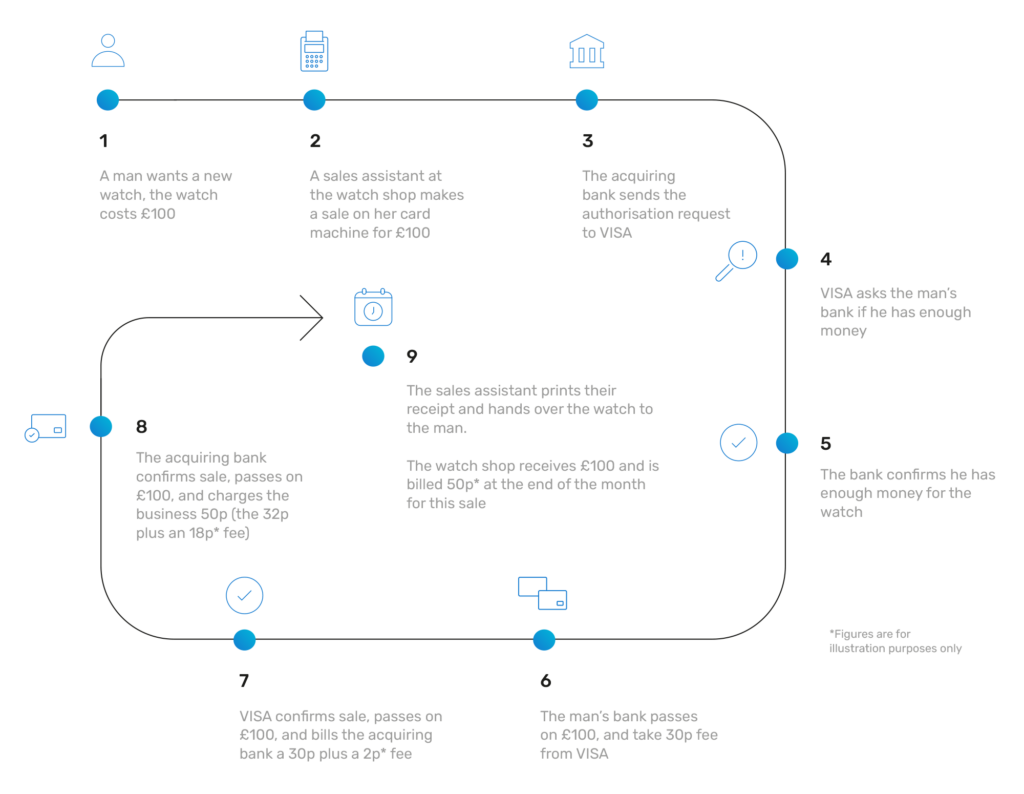

There are a few key players involved whenever your customer uses a card to purchase something from your business. Including:

When you think about it, it’s incredible really how such a seemingly complex transaction can be processed in a matter of seconds.

Here's what's happening behind the scenes:

But in more simple terms, there are three actions that happen whenever a card payment is made that involve the key players:

The customer uses their card and the payment gateway sends the information to the acquirer or payment processor who, inturn, sends the payment request to the card network or issuing bank. The issuer then checks to see if the card is valid and if they have enough money to make the purchase.

Whether the payment is accepted or declined, the information is then transferred back via the payment gateway to inform the customer and the merchant. If it is successful, the money is taken out of the customer’s bank account and held in the business’s merchant account.

The funds will be held in the merchant account for one to seven working days as a security measure before it is transferred to the business account.

You should know that if a customer purchases something from your business using a credit or debit card, you will need to pay an interchange fee.

You can’t avoid interchange fees if your business wants to accept card payments, and they are set by the individual card associations. They’re also non-negotiable but will vary depending on the card scheme used, for example, Visa or American Express card.

What you’re charged will also depend on whether you choose a blended pricing model or interchange++. Find out more in our interchange fees explained blog.

Credit cards and debit cards are processed in much the same way. However, debit cards usually have lower interchange fees because they’re considered a lower-risk purchase when compared to credit cards.

The reason why debit cards are thought to be lower-risk is simple. When a customer purchases something with a debit card, they are spending money that they already have, direct from their bank account.

When a customer uses a credit card, they are borrowing credit and therefore spending money that they don’t necessarily have. When a customer uses a credit card, the credit card company essentially extends a loan for the amount purchased in the transaction. The total sum of spends in a month is shown on a bill, which the customer is obliged to pay otherwise the credit card company will charge an interest rate.

Credit cards do have their advantages to businesses though. They are beneficial to your business as they allow consumers to spend more and allow more flexibility, especially when it comes to international spending.

As a business owner, however a customer spends — via either credit or debit card — is out of your control. But the more credit card transactions there are, the more fees you will likely have to pay at the end of the month. This is on top of all the other costs that come with card payments, so it’s important to understand all the fees so you can calculate them into your business costs.

The bottom line: you’ll want to make sure that the payment provider you work with is able to scale to your business needs and one that doesn’t rip you off.

Choosing the wrong online payment company can be a costly mistake. But you can easily avoid making that mistake with the right information.

For example, some companies might charge slightly different types of fees or hidden fees, including:

If you run a small business, the likelihood is you will have tight margins and will only have the budget for absolutely essential expenditures. So you will want to make sure that the company you do eventually go with will have a simple and effective billing process that works for you.

A good payments company will also provide:

The average transaction fee is anywhere between 1.5 - 3.5%. Transaction fees are set by the card schemes and are non-negotiable. The price is influenced by various factors, including what type of card is used by the customer (credit or debit card) and whether it is an international payment. The method of payment can sometimes affect the fee too, for example card-not-present transactions can cost more due to the risk factor.

Yes, technically it is possible. However, the alternative solutions can cost more per transaction. With Total Processing, we can quickly set you up with a merchant account or a high-risk merchant account so you can accept card payments with ease.

You will need a virtual terminal for that. Click on our service page to find out more information about how we can get you up and running taking card payments over the phone.

It’s very important that you choose the right online payments company correctly. Pick the wrong one, and you could be on the wrong pricing structure and paying more than you need to. Trust, transparency and good customer service and communications are key.

It just so happens that these are the values that we admire the most. But don’t just take our word for it. Check out our 5-star TrustPilot reviews.

And please, get in touch or visit our online payments and payment gateway service pages to get an idea of how we can help you to begin accepting online and in-store credit and debit card payments.