Real-time payments have become the new norm, offering convenience and efficiency like never before. If you're wondering how to get operationally ready for this fast-paced financial landscape, you're in the right place! In this simple guide, we'll break down the steps to ensure you're well-prepared for real-time payments.

In a world that thrives on instant gratification, real-time payments have emerged as a financial game-changer. Unlike traditional payment methods that involve waiting days for transactions to clear, real-time payments live up to their name by settling in seconds. This revolutionary approach to transferring funds and making payments is reshaping the way we handle our finances for both consumers and merchants.

Real-time payments operate on the principle of immediate transfer. When you initiate a real-time payment, the funds move from the sender's account to the recipient's account in a matter of seconds. This process is facilitated through advanced payment systems and technology that work seamlessly to ensure swift and secure transactions.

Now that we’ve quickly recapped the meaning of real-time payments and how it works, let’s look at how you get started with it.

First things first, you'll need to choose a reliable payment platform that supports this feature. Many banks and financial institutions now offer real-time payment options, but you’ll want to find one that ticks all your boxes for your business’s needs including:

Once you've selected a payment platform, make sure your systems are up to date. This includes both hardware and software. Real-time payments require the latest technology to ensure seamless integration. Regularly update your devices and applications to avoid any compatibility issues that may arise.

If you're a business owner, it's crucial to train your team on the ins and outs of real-time payments. Make sure everyone understands the new processes and is comfortable navigating the payment platform. This will help minimise errors and enhance overall efficiency.

With the speed of real-time payments comes the need for heightened security. Ensure that your chosen payment platform employs robust security measures such as encryption and multi-factor authentication. Educate yourself and your team on best practices for keeping financial information safe in the digital age.

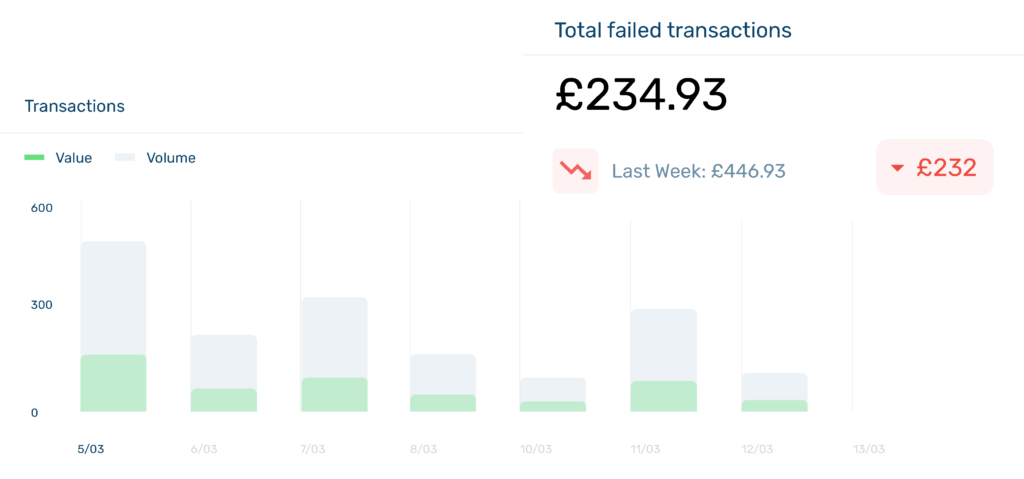

Real-time payments mean real-time monitoring. Keep a close eye on your transactions to detect any discrepancies or potential issues promptly and spot behavioural trends. Receiving alerts and notifications can also help you to stay on top of any suspicious activity.

Financial regulations are constantly evolving, and it's essential to stay informed. Familiarise yourself with the rules and regulations governing real-time payments in your region. This knowledge will not only keep you compliant but also help you adapt to any changes in the financial landscape.

We understand the importance of staying on top of the latest developments, that’s why we’ve partnered with Token.io; the leading provider of account-to-account (A2A) payments enabled by open banking. This partnership allows us to offer real-time payments to our merchants with complete ease.

On top of that, you’ll gain access to more than 300 acquiring banks, a fraud suite with 120 tools and a secure payment gateway collated in our all-in-one Total Control platform to manage these transactions seamlessly.

Becoming operationally ready for real-time payments may seem like a daunting task, but with the right approach, it's a seamless transition. By following these simple steps, you'll be well-prepared to navigate the world of real-time payments confidently. Embrace the speed, convenience and efficiency that real-time payments offer, and watch your financial transactions unfold in the blink of an eye.

Are you ready to take on real-time payments? Speak to one of our payment specialists today!