Ever since its grand reveal in 2014, Apple Pay has established itself as a formidable influence in reshaping the payment landscape! Recently, its commitment to maintaining a competitive edge in the market has been impressive to say the least, marked by a swift succession of new releases. These include innovations like Tap to Pay, Buy Now Pay Later and Apple Cash, all cleverly aimed at satisfying both customer and merchant preferences.

So, without further ado, let’s get ready to fully dive into the world of Apple Pay! We’ll be covering what it is, the benefits for businesses and how to get set up. But, before we get ahead of ourselves, let's quickly brush up on the basics. Don't worry, if you're already the Apple Pay guru, feel free to give the snooze-worthy technical stuff a miss and jump right into the benefits waiting for you further down the page.

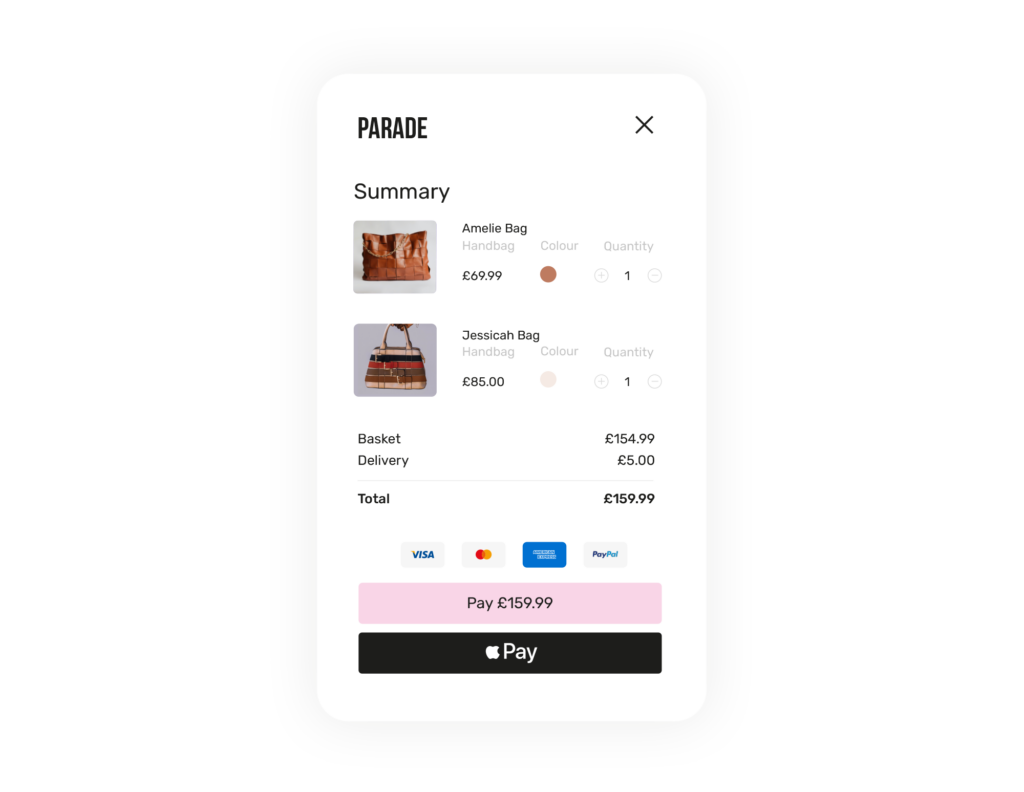

Apple Pay is a really simple mobile payment method that lets you pay for things quickly, easily and securely without the need to carry a physical credit card or debit card. Rather than fumbling for their card and dealing with Chip & PIN or contactless hassles at the counter, customers can simply use the Apple Wallet App on their trusty Apple devices—whether it's an iPhone, iPad or even an Apple Watch. It’s pretty smart really, and the proof is in the pudding as the seamlessness of Apple Pay has helped businesses increase checkout conversion rates, improve customer loyalty and reduce checkout time across the board.

To pay with Apple Pay is nice and easy. All it involves is adding your debit and credit card information to the Apple Wallet App on a chosen Apple device. Customers can use it in exactly the same way as regular contactless cards to make card transactions. They simply hold their Apple device near the POS terminal, and NFC technology (Near Field Communication) will enable the contactless payment.

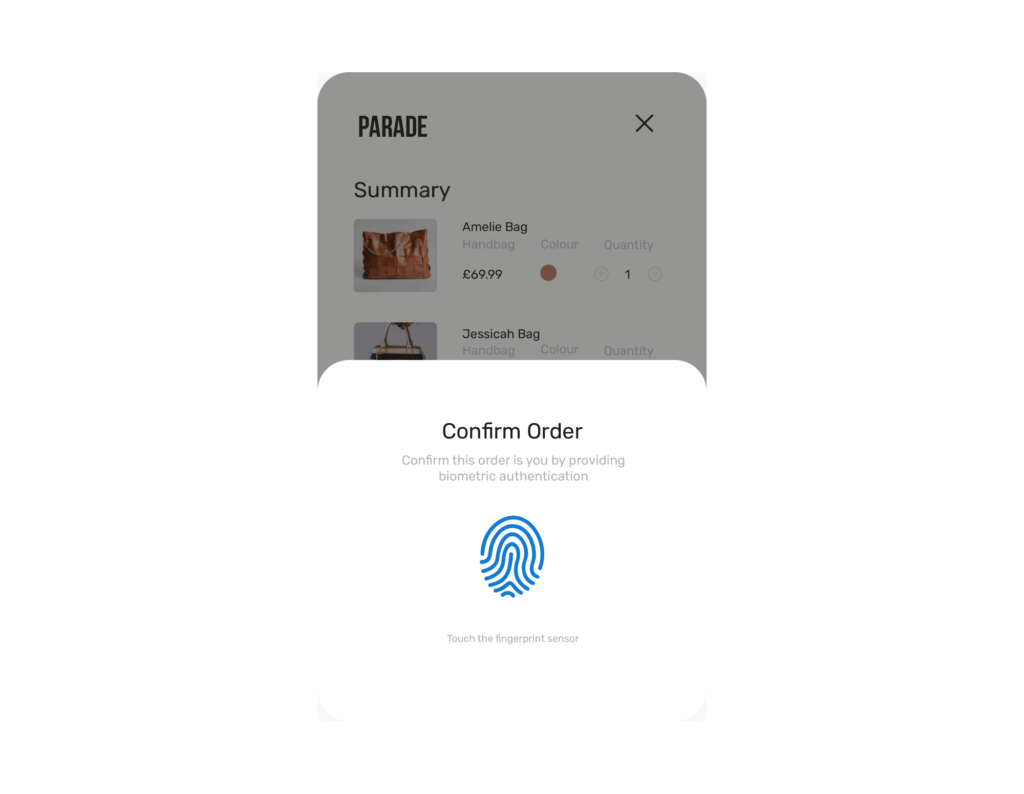

For added security, they’ll have to confirm the payment with a passcode or biometrics. It's also easy to use Apple Pay to pay for products online in a couple of clicks by using the Safari browser on an iPhone, iPad or Mac.

While we’re on the topic, Apple Pay is one of the most secure methods of paying there is. When your customers integrate their card into the Apple Wallet, their card number and other details are all encrypted.

This is by using a method called payment tokenisation, effectively replacing the card's specifics with a randomly generated alphanumeric string—referred to as a token or Device Account Number. Even Apple's servers don't retain sensitive information, providing an extra layer of protection for everyone’s peace of mind.

Pretty much all Apple users can use Apple Pay these days. They just need one of the following:

Apple Pay supports most major credit and debit card providers including Visa and MasterCard; Apple’s Apple Card is also supported but this is currently only available in the US. Over 60 countries support this payment method and odds are your corner of the globe is already tapping into its convenience! Apple’s own support page runs through a handy step-by-step guide on how to set up Apple Pay for any of the above devices.

Since 2021, UK customers can now use contactless card payments to make a payment of up to £100. However, there’s actually no limit on how much you can spend using Apple Pay.

This applies for transactions that are made in-app or using a browser too. Bear in mind that individual retailers can decide to set up a limit on Apple Pay payments if they want.

Now we’ve got that out of the way, let’s address the real question here. Why should your business bother to accept Apple Pay? What benefits does it bring?

Overall, there’s really no reason not to add Apple Pay as a payment method! Now we’ve established how much Apple Pay can contribute to successful conversions, let’s run through what you need to do to start accepting this payment method for your business.

Firstly, let's establish clarity on Apple Pay's bank support—virtually all major banks endorse it. From its initial launch, prominent UK banks like First Direct, HSBC and NatWest readily issued credit and debit cards compatible with Apple Pay.

Recently, contemporary digital-first current account providers, such as Monzo, Revolut and Starling Bank, have also embraced it. In essence, this modern payment method is accessible and likely to be used regularly by a high percentage of your customers.

So, let’s get the ball rolling on you offering your customers that seamless payment journey they want. With Total Processing, there isn’t any additional set-up or cost needed to start taking Apple Pay in your business. All of our card readers come with it enabled as standard, and can be integrated into your online checkout. Get started with us today!