Gone are the days when you could only accept cash or cheques as a form of payment. In today's digital age, the world of commerce is evolving faster than ever with more online payment options than we could’ve imagined.

For merchants, adapting to these changes is not just a choice; it's a necessity. Online payment methods have become a cornerstone of modern business, and in this blog, we'll explore the ins and outs of these payment solutions and which methods are an absolute must to offer your customers.

What’s in this article?

It’s pretty simple, but just so we’re all on the same page, let’s recap what an online payment method is. Online payment methods are digital alternatives to traditional forms of payment, e.g. cash and card, designed to streamline transactions for both customers and businesses. They allow your customers to pay you swiftly and securely, enhancing their shopping experience and, consequently, boosting your sales.

With a huge shift from brick-and-mortar stores to e-commerce websites, the way consumers pay had to shift too, to meet the change in customer expectations.

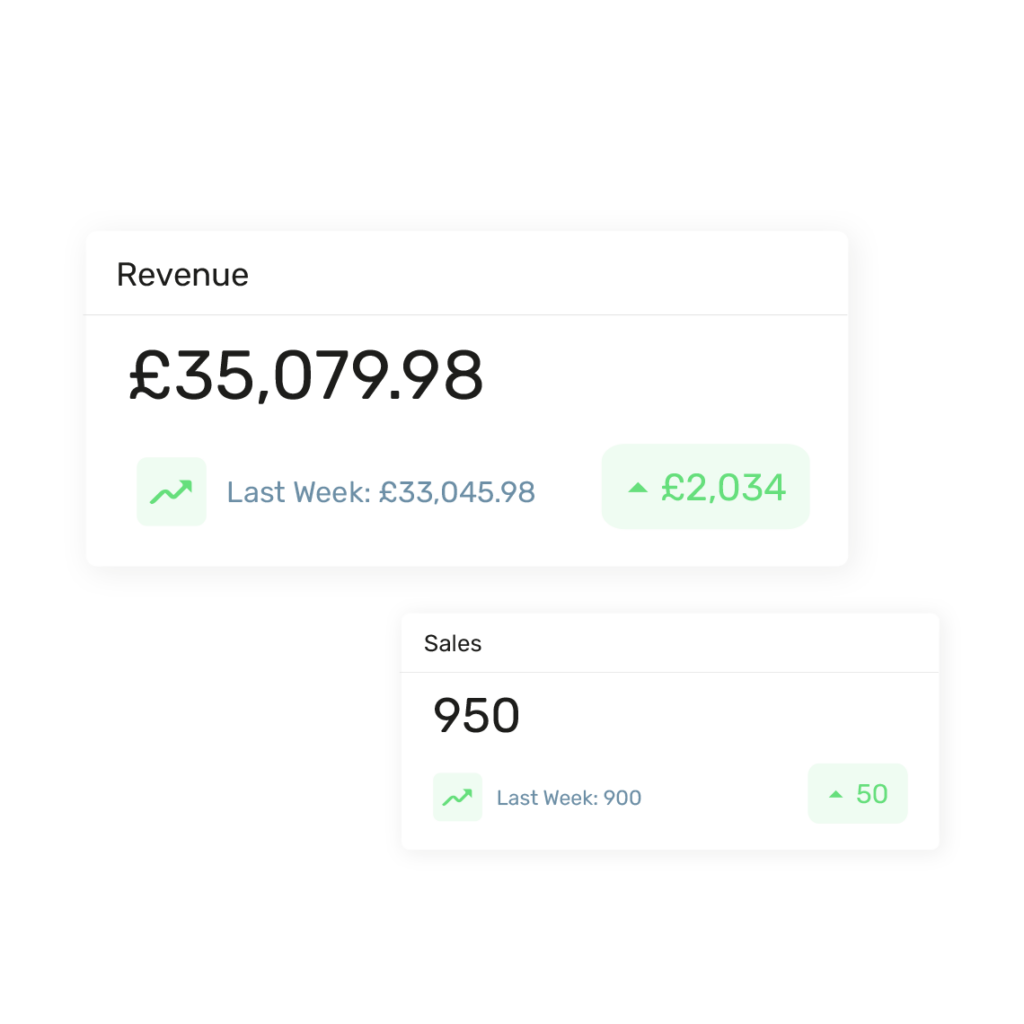

These days, there are so many payment options to choose from. In fact, we have more than 198 alternative payment methods! But which ones you choose to offer will depend on the location of your business, your business model and your customer's preferences. Let’s take a look at the most popular options:

In today's digital landscape, credit and debit cards have stood the test of time, making them a popular choice for online payments. Introducing a card payment system enables you to seamlessly accept online payments, with Visa, MasterCard and American Express ranking among the most widely used choices.

Digital wallets are the most extensive with so many different ones to choose from. They provide the convenience of one-click payments and are ideal for mobile payments. Popular services include Apple Pay, Google Pay and Samsung Pay.

A digital wallet that deserves its own section is PayPal; widely recognised and used by millions. Integrating PayPal into your website or store can open the door to so many possibilities and a broader customer base. It’s reputation cannot be ignored; it’s status as being one of the biggest digital wallets around, along with PayPal's Buyer Protection programme, makes it an option customers trust.

Bank transfers have often been ideal for larger transactions. But with real-time account-to-account payments increasing in popularity with the development of open banking, these types of payments are becoming more widely used for all sorts of payments.

For tech-savvy and forward-thinking merchants, cryptocurrencies like Bitcoin and Ethereum offer a decentralised, secure payment method.

Security is paramount in the digital realm. Credit cards, digital wallets and the functionality needed to take payments online, such as a payment gateway, are renowned for their robust security features, including encryption and fraud prevention tools. Since all online payment methods are required to comply with the Payment Services Directive Two (PSD2) and will need to complete some form of authentication, customers can rest assured that their transactions will be safe.

The only online payment method that may need a bit more attention to remain secure is cryptocurrency payments. Although they are secure, crypto will require a deeper understanding to ensure safe transactions since they don’t fall under the same regulations as the rest.

We’ve mentioned that it has become a necessity to accept online payments, but what are the real benefits?

Like anything to do with payments, and business in general, of course, accepting online payments doesn’t come without its challenges. Here are the key areas for you to be aware of:

In the ever-evolving world of commerce, online payment services are essential for merchants. They provide convenience, efficiency and the opportunity to tap into a global market. While there are challenges, the benefits far outweigh them, making it a step forward that no business can afford to miss.

So, if you’re ready to embrace the future and integrate online payment solutions into your business model, then get in touch. Your customers will thank you and your business will thrive in this new era of commerce.