Whilst this payment method is by no means new, having been widely used in the hospitality industry, its use across other industries is becoming more popular. The reason for this comes with the increasing effort to improve the customer experience by reducing any friction at the checkout.

Let’s take a look at the benefits of a payment link and how it has developed to be used in many ways.

Pay by link, also known as ‘request to pay’, is a quick and easy method to send your customers a convenient and secure way to make a payment. This type of payment falls under contextual commerce.

What is that? Well, it’s basically a push method of taking payments that is organically implemented into the day-to-day activities of the consumer. For example, if a customer is scrolling through Instagram and they see a product they want, they can purchase it there and then within the app.

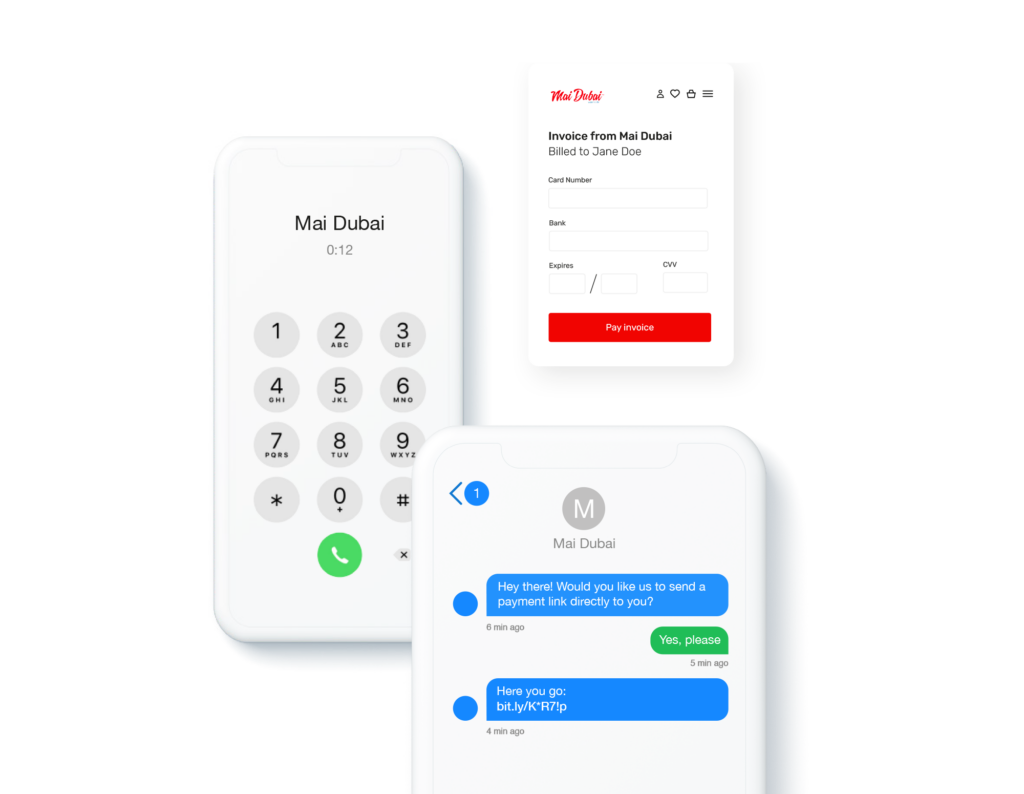

So, with payment links, the payment can either be made in the moment whilst on the phone to the merchant but via their own device rather than telling the advisor their payment details or in their own time when it naturally fits in with their daily tasks.

One of the biggest benefits of pay by link is that they don’t necessarily require you to have a website, so they’re an ideal solution for all businesses.

Although you can customise the way the payment link is displayed, its primary function is to provide a good customer experience. In involving the customer only when it is necessary, request-to-pay schemes use customised payment pages and unique reference codes where the consumer has to simply confirm the amount that they want to pay. The items and quantities are already allocated, and other variables, such as delivery, have been resolved before the customer has even arrived in the payment journey.

Details from the customer’s device will be pushed to the merchant through the payment link, and the customer will get real-time confirmation after the payment is made. It doesn’t get much more convenient than that!

In situations where the customer has yet to register their details also remain relatively frictionless. Most commonly using their device’s autofill features via Apple Pay or Google Pay, the process is quick and tokenised, ready to be used again at a later date.

Bringing commerce to people, instead of people to commerce – regardless of the context – is the key USP of pay by link. With the ability to increase sales and open revenue channels for merchants, pay by links work wonders in upholding the customer journey through to completion, as well across the recurring billing payment model.

Since you can customise payment links, and they can be used for both one-time payments and recurring payments, there are multiple applications where they can be used, including:

One of the biggest concerns about chatbots, especially in a customer service situation, is sharing sensitive data. Using payment links allows customer service agents or automated systems to securely comply with PCI DSS standards whilst maintaining an informal rapport with their customers.

Thanks to changing rules surrounding open banking, payment links can also be used in peer-to-peer situations across messaging sites to prevent bank details from being shared. So if there are any concerns around the security of pay by link, rest assured they are more secure than more traditional methods.

The most common form is pay by text. SMS links are commonly used across the hospitality sector. The customer is often asked to confirm their appointment or booking, whereby doing so the merchant will be able to charge them after the fact.

There are so many opportunities with scenarios similar to this to provide a smooth customer experience. For example, a couple could make their reservation for a meal online and fill in their billing information at the same time. They then go on to enjoy their meal and simply have to confirm their payment via SMS afterward.

Or, your customer is at the hair salon, having frequented it often, their billing information is already on record. They leave the salon, only having to confirm the amount they want to pay via a link. So simple and convenient.

Working similarly to SMS, as 45% of people open ‘abandoned cart emails’, email payment links are commonly used to convert across ecommerce businesses. Using the link, the customer can be taken directly to the checkout, sometimes with a discount incentive to reduce a global cart abandonment rate of more than 75% across all devices.

Other use cases include invoice payment links as the number of B2C digital invoices is set to grow to 27.7 billion by 2024.

Less obvious than our other use cases, payment links that appear in social feeds are often disguised as part of the User Interface (UI). They appear as you tap on a photo in your Instagram feed where you can then follow through to the payment stage or pay with your phone’s default payment setting without even leaving the app.

This is arguably the most recent use case of contextual commerce due to the 55% of abandoned transactions that come from social media purchases alone. Customers found themselves abandoning a purchase after encountering too many steps following a jump at a social touch-point.

Payment links are commonly used within a recurring billing model to not only register an initial payment, but to then continue to authorise payments on a weekly, monthly or annual basis. Equally, with pay-later schemes, such as Klarna slice-it, a payment link is commonly sent via email for the customer to pay by. Merchants can also manually reissue payment links as part of a reminder protocol to avoid arrears in sectors such as the insolvency industry, making managing payments much easier for both the merchant and the customer.

Requiring the utmost compliance with PCI DSS standards, similar to chatbots, payment links are one of the most popular ways for customer service agents to take payments over the phone without keying them in with a virtual terminal. According to PCI SSC, the average data breach will cost £3.2 million. In removing the need for card details to be read over the phone, liability for the merchant is reduced making it much more secure and convenient for all involved.

Aside from ease and convenience, security is a big benefit for pay by links. Removing the risk of manually taking personal details (i.e. over the phone), data is much less likely to be compromised.

Total Processing’s pay by link services hold the highest level of PCI DSS compliance alongside customisable fraud tools so you can rest assured that your payments are in safe hands.

Merchants also have the added assurance of taking payments via most traditional and alternative payment methods, including Apple Pay and Google Pay, allowing you to cater to a truly omnichannel payment journey.

Consumers expect quick and convenient these days and that’s exactly what payment links can offer. The frictionless shopping experience with minimal steps and the option to pay how and when they want will be very attractive to your customers.

There are a lot of benefits for the merchant too. With Total Processing’s platform, Total Control, you can create, send and track your payment links all in one place. And with real-time updates when a payment has been made, they take minimal effort to manage.

As you can see, there are so many benefits to using pay by links. To learn more or to begin accepting pay by links, get in touch.