Cryptocurrency has become a global phenomenon. All around the world consumers are buying and selling digital assets, and playing virtual games built around them. Businesses have even jumped on board and have made it possible to use crypto as payment.

But, although cryptocurrency has been around for a while now and is continuously growing at an extremely fast rate, there’s still often confusion around it. So, we’re going to take a look at why it’s become such a popular alternative payment method.

Bitcoin was the first cryptocurrency to be backed in 2009, and to this day is still the most widely recognised and used digital currency in the world. But what makes crypto in general so special?

Many companies, including giants like Microsoft, Dell and Dish are accepting cryptocurrency as payment. What started as a peer-to-peer monetary transfer has now integrated into business transactions, especially in industries like tech. And with the benefits mentioned above, it’s not hard to see why. The combination of security, speed and lower fees makes it a no-brainer to add it to your payment offering, changing the global economy.

Some businesses use crypto in other ways too, for example, blockchain-based smart contracts. This is a program stored on a blockchain that runs when predetermined conditions are met to automate the execution of an agreement, aiming to help reduce the pressure heaped on small-to-medium businesses. They avoid countless processes of invoicing, inventory, payroll and secure transactions. Instead, they offer a process that enables SMBs to create, validate and approve contracts to suppliers, clients or customers quicker and easier.

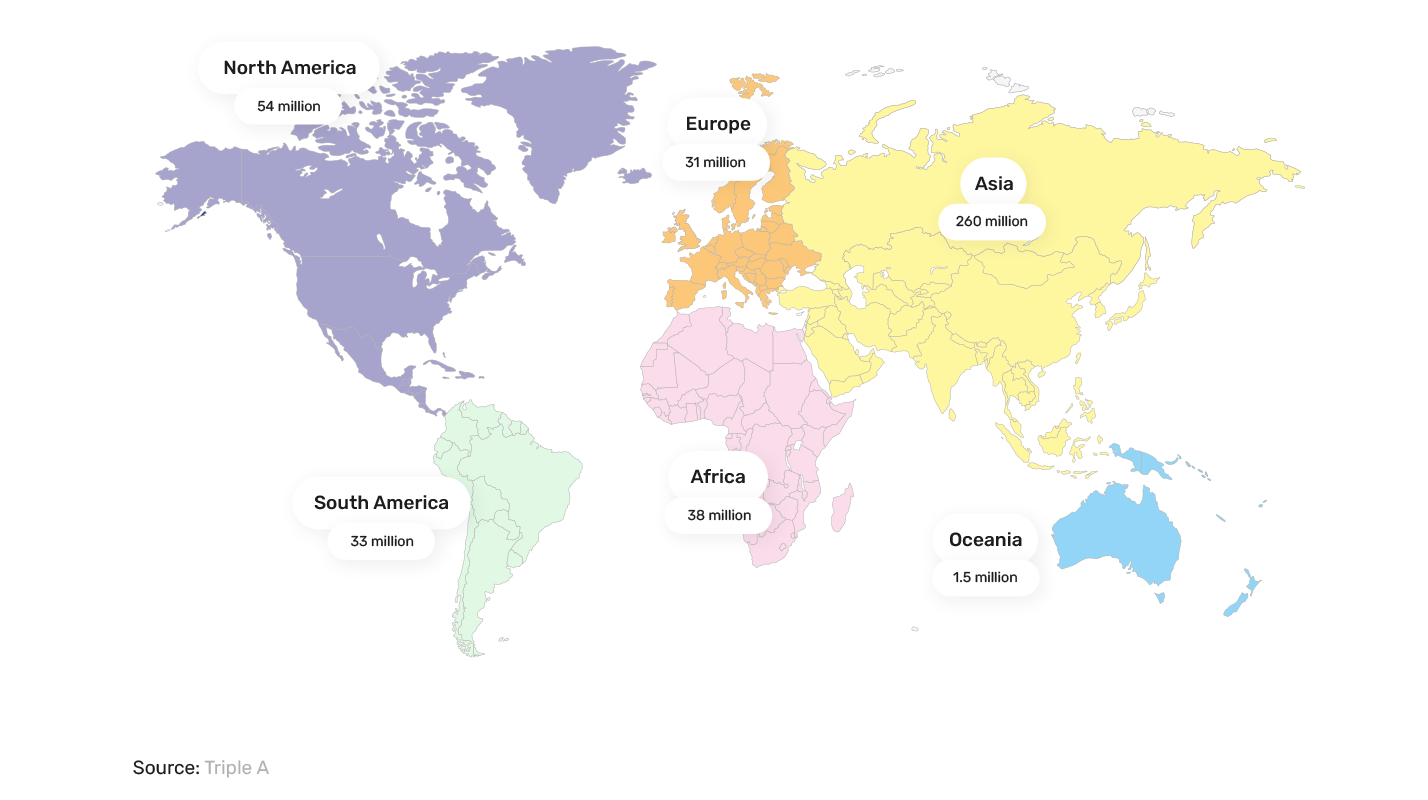

The cryptocurrency global market cap is huge, but which countries are dominating? Take a look at the map below to see where in the world cryptocurrency is most common.

2022 hasn’t been a good year for the industry. As of December 2022, the global market cap was $858.43 billion; a drop from the previous year which hit a trillion dollars. Despite this, investment and trust are still high.

With being such a volatile industry, crypto businesses need a high-risk merchant account to be able to accept card payments. But once you have that in place, you can accept global payments. Obtaining a merchant account, even a high-risk account, can be tricky when you fall into this sector, but with Total Processing, we have access to more than 300 acquiring partners making it much easier for us to find an account right for you.

If you’re ready to accept cryptocurrency payments from around the world, or if you’re in the crypto industry, get in touch with our specialist team today.