Introducing the latest updates in financial regulations: PSD3, the newest version of the Payment Services Directive. This update is all about enhancing security measures and making sure merchants and their customers are better protected in the payments space. In this blog, we'll break down the main differences between PSD3 and its predecessor, PSD2, and run through why these changes help your business.

What’s in this article?

PSD3, the third iteration of the Payment Services Directive from the European Commission, represents an updated version of its predecessor, PSD2. In simple terms, it’s just an updated set of rules designed to safeguard consumers, merchants, payment providers and banks.

Predicted to be finalised by 2024 and implemented in 2026, this latest directive places a spotlight on specific areas, such as Strong Customer Authentication (SCA), 'spoofing' prevention and enhancements to the open banking framework. PSD3 focuses on topics that weren’t paid enough attention in PSD2 and addresses emerging technologies that have gained popularity in recent years. We’ve highlighted the main changes that you’ll want to hear about:

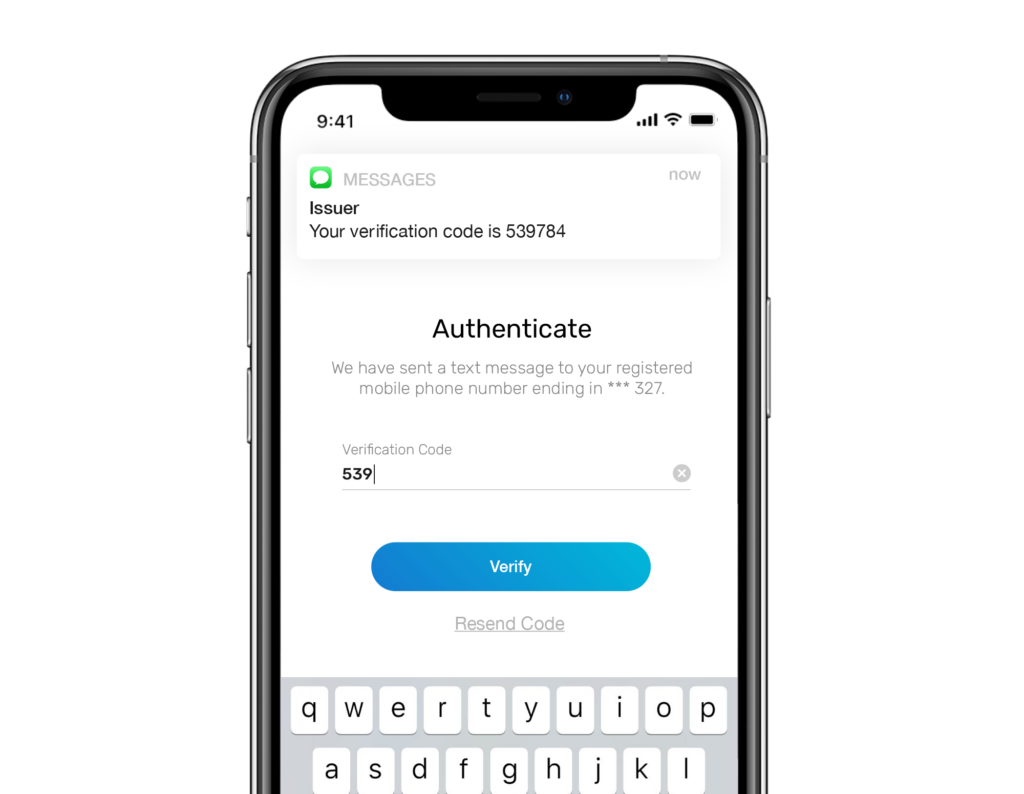

One improvement brought by previous directives is, without a doubt, the emphasis on SCA requirements. This security feature requires customers to provide at least two pieces of identifying information during the payment process. The proof is in the pudding, and regions enforcing SCA have seen a substantial decrease in card-not-present (CNP) fraud rates.

However, the implementation of SCA has raised valid concerns about increased friction at the checkout, potentially creating a negative experience for customers. Recognising these issues, PSD3 introduces new requirements to address and improve upon the existing framework:

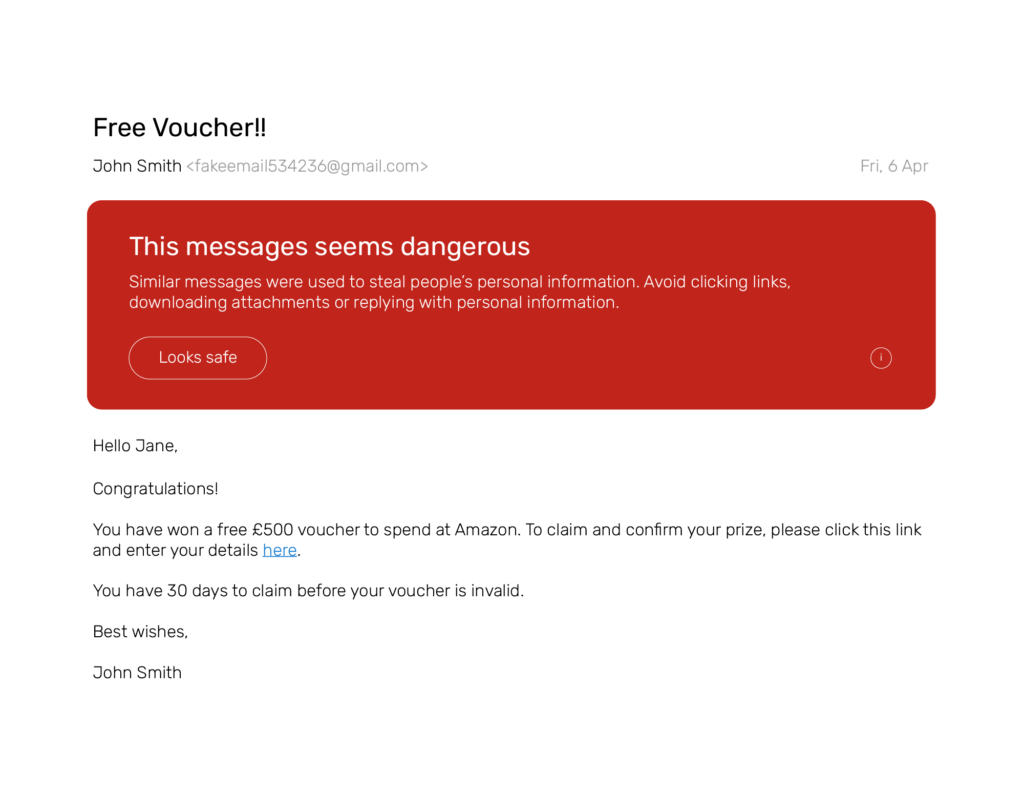

Spoofing is a pretty deceptive technique in which fraudsters trick customers into consenting transactions by mimicking trustworthy sources like a bank’s email address, phone number or website. The European Commission has acknowledged the need for additional regulations to effectively prevent and detect this type of fraud:

Open banking, a system enabling secure sharing of a customer's financial information among banks and financial institutions, has shown its usefulness in revolutionising various financial tasks, including payments and investments. With its countless benefits, it comes as no surprise that its popularity is soaring, boasting eight million users in the UK by November 2023.

In an effort to enhance the functionality of data sharing between banks and third parties, PSD3 is introducing several changes:

It’s important not to forget that the UK is no longer required to follow PSD3, however it’s likely it’ll alter its own rules in a very similar way. So, it's crucial that you stay informed about these upcoming changes for compliance reasons. But let's not lose sight of the main point – in this evolving payment landscape, PSD3 aims to provide protection and convenience for all merchants navigating the shifts in this complex industry. Understanding and embracing PSD3 will be essential in helping your business adapt and thrive in the changing digital world.