Have you ever wondered why some people prefer certain recurring payment options over others? Well, the answer might be closer to home than you think. Location plays a significant role in shaping our recurring payment preferences.

In this blog, we'll explore how different regions view and choose their recurring payment options, including the challenges of cross-border transactions which are crucial to overcome if your business goals include global expansion.

What's in this article?

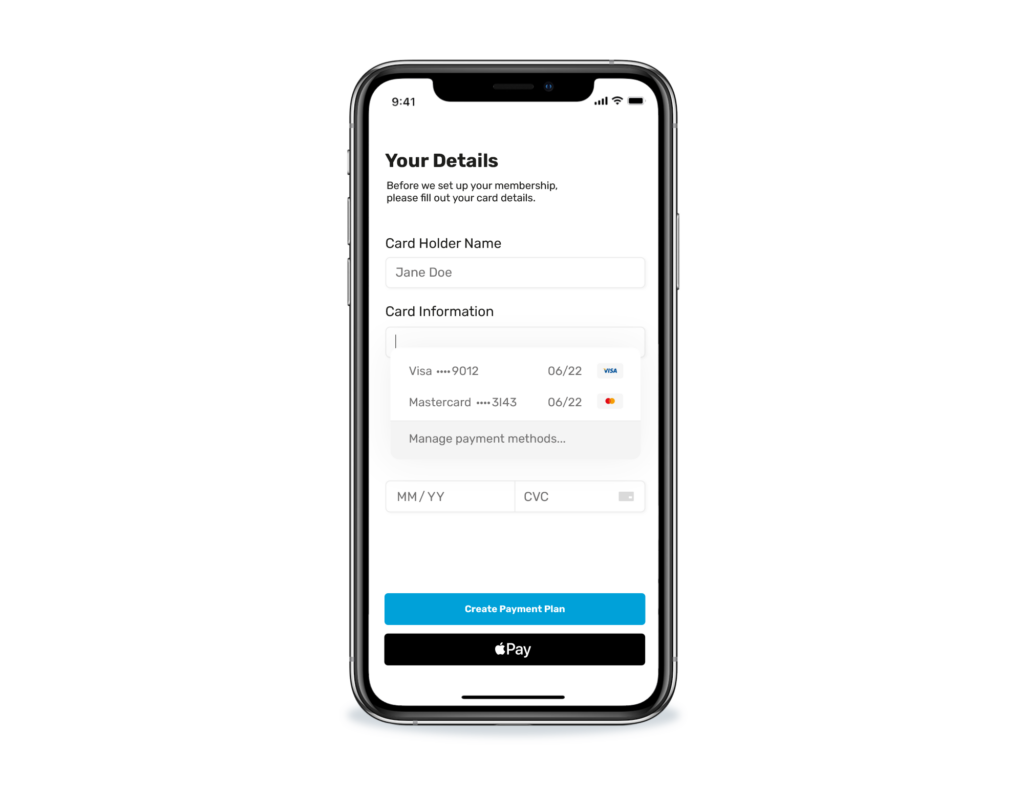

Recurring payments are automatic, regularly scheduled transactions that make our lives easier. From subscription services like Netflix and Spotify to utility bills and gym memberships, they've become an integral part of our financial routines. But, the local payment methods people prefer can vary depending on where they live.

Here's a list of common recurring payment methods:

These recurring payment options offer flexibility and convenience for both consumers and businesses, catering to a wide range of preferences and needs. It’s advisable to offer more than one payment method, not just for consumer preference, but also in case one payment fails it can fall back on another.

Each region has its own cultural differences, so it’s no surprise that they will have their own differences when it comes to payments too. For example, some regions may have a stronger preference for traditional banking methods due to a historical trust in banks, while others may embrace newer fintech solutions due to a culture of innovation.

These preferences can make all the difference in whether a region will adopt or reject the latest trends and technologies.

On top of that, each region will have its own security procedures. For example, the European Union's General Data Protection Regulation (GDPR) has influenced consumer payment preferences by emphasising data protection and privacy.

To give you a few examples, let’s take a look at the recurring payment preferences for the UK, UAE and Europe according to a YouGov survey.

In the United Kingdom, debit cards are the recurring payment method that reigns supreme, even more so than credit cards. They’re simple, reliable and widely accepted. Many Brits prefer this method for everything from paying their rent to supporting their favourite charities. They’re a breeze to set up, and they provide a level of financial control that suits the British sensibility.

Although, that doesn’t mean you should forget other payment methods. APMs like digital wallets, are also very popular, particularly with the younger generation and must be included in your offering.

Now, let's jet off to the United Arab Emirates (UAE) to discuss their preferred payment options. Here, credit card-based recurring payments are quite popular. The UAE is known for its modern, tech-savvy population, and credit cards are the go-to payment method for many. It allows them to enjoy the convenience of recurring payments while earning rewards and cashback on their spending.

Pay by links are also popular, so recurring invoices, allowing them to pay when it's convenient for them, is something you should consider.

Europe is a diverse continent, and payment choices across the different countries can vary. However, in general, Europeans tend to favour SEPA Direct Debits for recurring payments. SEPA makes it easy to set up automated payments across Eurozone countries, eliminating the need for different bank accounts and payment methods for each country.

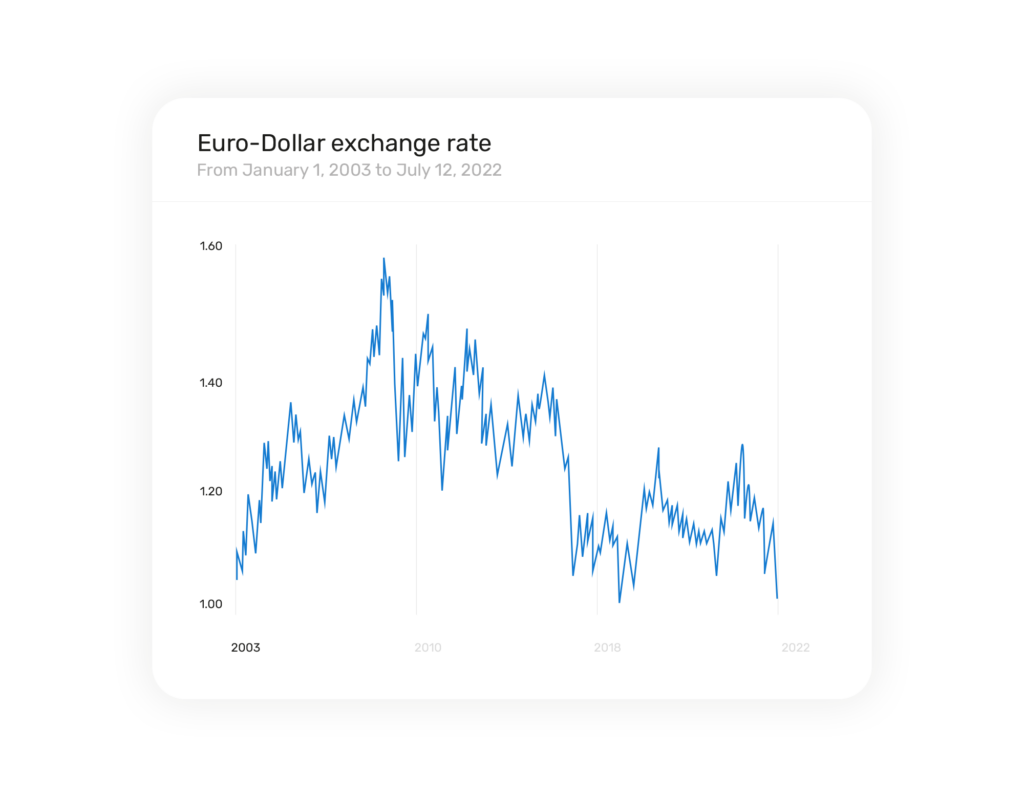

Cross-border recurring payments can be a bit of a headache. When you're dealing with different currencies, time zones and financial regulations, things can get complicated. This often leads to individuals and businesses in one country preferring certain payment methods to avoid the hassle of dealing with international transactions.

Common challenges associated with cross-border recurring payments include:

Although it may seem like there are a lot of challenges when it comes to cross-border transactions, there is a simple solution; use local acquirers. By using acquirers based in the countries you want to process in, you can increase approval rates, decrease processing times and limit the amount of fees you’re charged.

But how do you go about achieving this? With the right payment processing service you can easily expand your business to accept global payments. At Total Processing, we offer a multi-acquiring strategy that enables you to connect to a network of hundreds of acquirers. On top of that, we offer more than 198 alternative payment methods, so you can easily let your customers pick their method of choice.

Location is not the only factor influencing recurring payment preferences; the rise of open banking has also played a significant role in how people manage their finances. It gives us more choices, real-time updates and makes cross-border transactions easier. It's secure and trusted, but its availability varies by region, with the UK and parts of Europe leading the way.

Understanding how open banking is being embraced in the location you want to expand your business to can significantly impact your recurring payment options. It's an exciting development that provides enhanced choices and convenience, making it easier for individuals and businesses to manage their finances and automate payments.

Location matters when it comes to recurring payment preferences. The ease and convenience of certain payment methods can be a game-changer, and people tend to stick with what works best in their region. Whether it's the simplicity of Direct Debit in the UK, credit cards in the UAE or SEPA Direct Debits in Europe, location shapes your customer’s payment habits.

So, the next time you're pondering how to improve your recurring payments solution, take a moment to consider where you’re processing. Your location might just hold the key to the most convenient and hassle-free payment method for you. And if you’re ready to optimise your payment package to boost your monthly recurring revenue, why not get in touch and we’ll see how we can help you expand internationally.