Whether you’re a subscription service or an e-commerce business offering a repeat delivery of products, the security of recurring payments should be a top priority. You’ll need to safely gather, process and store your customer’s sensitive data.

In this blog, we’ll unravel the layers of protection surrounding these transactions and explore the secure payment methods that ensure your customers' data stays safe from cyber threats.

What's in this article?

There are a range of technologies and tools used so you can manage recurring payments securely. Let’s take a look at the most effective:

Security concerns are one of the biggest causes of abandoned carts. So, maintaining the trust of your customers requires a commitment to the highest standards of data security. This is where Payment Card Industry Data Security Standard (PCI DSS) compliance comes into play. Although it’s mandatory to comply with these industry standards, such as implementing 3D Secure 2.0, to protect your customers' information, it also demonstrates your dedication to maintaining a secure environment. Displaying the PCI-compliant badge becomes a symbol of reliability in the eyes of your customers.

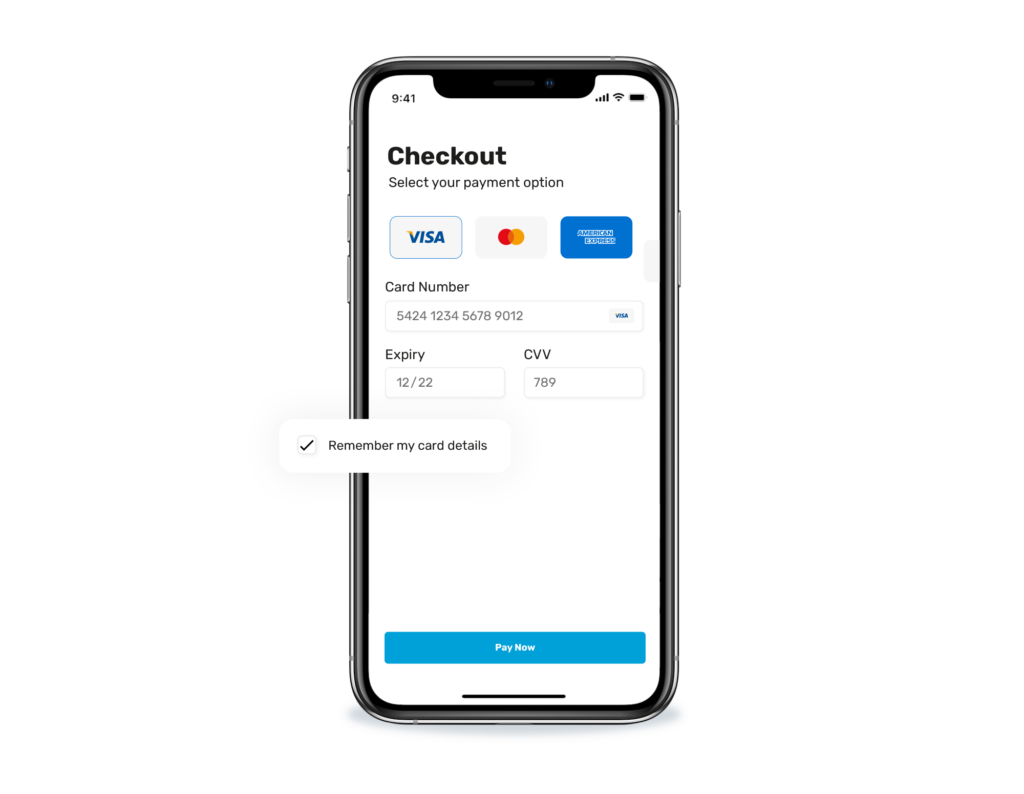

As a merchant, you’ll understand the critical importance of safeguarding your customers' financial information. Tokenisation is your ally in succeeding with this. When it comes to keeping your customer's card information on file, by replacing sensitive data (like a credit card number) with a token (a random and unique string of data), you ensure that even in the event of a breach, the actual payment details remain inaccessible. Implementing tokenisation is a strategic move to strengthen your payment infrastructure and build trust with your customers.

Let’s go into more detail about 3DS2 payments. This authentication measure verifies a customer’s transaction via a number of ways, including a PIN, one-time passcode or facial recognition. This added security measure ensures the cardholder is who they say they are.

For more information on 3DS recurring payments, check out our blog on ‘What is 3D Secure authentication?’.

Your payment gateway acts as the first line of defence against potential threats. Opt for a secure payment gateway that encrypts data during transactions, rendering it indecipherable to any unauthorised parties. This encryption not only protects your customers but also shields your reputation as a responsible and secure merchant.

Now, let's delve into the methods that make recurring card payments secure for both merchants and customers:

Mitigating fraud is not just a customer concern; it's vital for maintaining the integrity of your business. Here's how you can actively contribute to fraud prevention:

For more tips, check out our blog on how to prevent fraud in business.

As merchants, the responsibility of protecting your payment processing rests in your hands. Embrace the advancements in technology that provide innovative and secure subscription payment solutions, whether it's tokenisation, PCI compliance or secure payment gateways.

As a payments provider, we offer all the tools needed so that you can prioritise the security of your customer's financial information to not only fortify your business against potential threats but also foster lasting trust with your customers.

So, merchants, rest assured that with these security measures in place, you can confidently offer recurring payment options, knowing that you're providing a secure and trustworthy experience for your valued customers. So, if you’re ready to offer seamless and secure recurring transactions, we’re ready to help you get started!