Accepting recurring payments is an effective way for your business to improve its cash flow. Why? Well, it’s essentially recurring revenue, which makes it much easier to predict future revenue.

But how do you manage recurring payments to make the most out of them? In this blog, we’ve given you our top tips on how to handle and set up recurring payments.

What’s in this article:

Before we get into it, let’s start with the basics. What do we mean by recurring payments? Rather than a one-off transaction, a customer can make a repeated payment for a product or a service such as a subscription, like Netflix. The customer will grant permission for the funds to be taken on a predetermined schedule, whether that’s weekly, bi-weekly, monthly, etc. until the contract comes to an end, or the permission is revoked.

Unfortunately, simply accepting recurring payments isn’t enough. Customer loyalty can be hard to come by; 32% of customers will cancel their service if they receive a single bad experience. That’s a high percentage that won’t give you a second chance!

So, being able to manage recurring payments properly is crucial to a business's success.

Here are our top tips on how to manage recurring payments:

Who doesn’t like an automated process? Recurring payments don’t just have to be automated for the customers but can be for the merchant too. With the right platform, you won’t need to manually take the payments every time. As soon as they are set up, the funds will automatically be taken on the agreed date, saving your business time and resource. Not only that, but it will also improve accuracy, reducing the amount of data input errors.

And since they are automated for the customers, those funds should keep on coming like clockwork.

There will be times when payments fail; it’s completely normal and nothing to worry about as long as you have the right tools in place to reconcile them. They can fail due to a number of reasons, but most commonly it will be down to expired card details or not enough funds in the customer’s account.

You can easily rectify these with a few smart tools, like multi-card registration, account updater and auto-rebiller. So, just like everything in life, as long as you have a plan in place to manage failed recurring payments, then you’re in a good position.

Find out more about these tools from our recurring payments page and see how we can help you get those payments paid.

There are certain times that are more suitable for consumers to make payments, and everyone is different. This is where your data will come into play. Based on failure and success rates, Total Control can utilise this information to work out optimum billing times to increase your chances of a successful payment first time.

Knowledge is power in most instances, certainly when it comes to collecting recurring payments. We’ve already covered how it can influence optimum billing times, but it can also help you keep track of payment statuses, learn from customer behaviour and trends and build business strategies for the future.

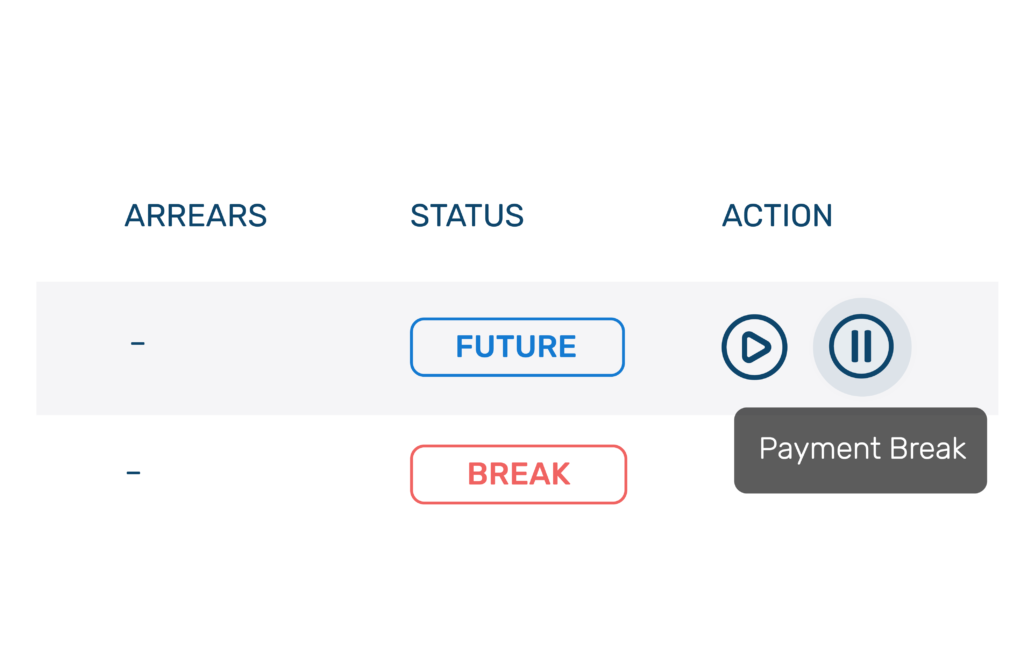

Want to beat churn? The dreaded word for all merchants. The best way to manage recurring payments so that your customers stay loyal is to give them control. Offer flexible schedules with the ability to take payment breaks and make alternative payment methods available so they can pay with their preferred method.

Making your product or service easily slot into your customers’ lives, rather than being a burden, is a sure way to guarantee customer satisfaction.

Last, but certainly not least, is communication. If you want to avoid a chargeback, you’ll want to keep your business at the forefront of your customers’ minds. We’re not talking about marketing communications, we’re talking about being upfront about your billing policies so that they know what they are signing up for. Clear communication builds trust and reduces disputes.

This includes any issues that occur, payment reminders and how the transaction will appear on their bank statement. It’s not always super clear with your brand name in the description. As long as the customer is aware of how it will appear, they will recognise the transaction and know that it’s you.

As a merchant, recurring payments can be an absolute game-changer! There are many perks when managed correctly, making it a priority to get it right.

So here are the main reasons why it’s so important to manage recurring payments:

In a nutshell, recurring payments are a merchant's best friend. They bring financial stability and allow you to predict future revenue – crucial for making business decisions.

It's no wonder why businesses everywhere are embracing the power of recurring payments!

If you want to implement all these tips, then you’re going to need a payment provider that allows you to do so. That’s where Total Processing comes in. Here’s a quick overview of how to get started with setting up recurring payments:

What if my customer’s transaction is declined?

There are reconciliation features in place to ensure the transaction goes through. If it’s due to a lack of funds, then the payment can be automatically retried at a different time, or you can send a pay by link so that the customer can make the payment at a time that suits them.

What if my customer’s card is out-of-date?

No problem, our account updater tool will automatically update expired, lost or stolen cards with their latest card information.

Will getting a new debit card stop their recurring payments?

No, getting a new card will not stop recurring payments that are set up if you utilise the account updater. Just like above, the customer’s card details will automatically update so there’s no interruption to their payments.

What if the customer wants to stop recurring payments on their credit card?

If the customer wants to cancel their recurring payments, depending on the reason, you have a couple of options. You can either offer multi-card registration so that the payments can be taken from a different card or offer them a break in the schedule if it’s due to financial strains. So, don’t worry, there are a few tactics to prevent losing the customer altogether.

Are you ready to see the benefits recurring payments could have for your business? Now you know all the tricks to efficiently manage recurring payments, have a chat with one of our payments specialists and let’s get you set up. Alternatively, why not check out some more tips on the best ways to accept recurring payments?