You know about Apple Pay, right? Well, there's this lesser-known term called ‘OEM Pay’ which stands for ‘original equipment manufacturer’. But don't worry, it's just a fancy way of saying it's a payment method that comes built-in with your phone.

But then we have Issuer Pay; a payment method that needs to be installed on your phone, like Alipay.

To make it even more interesting, Google Pay used to be called Android Pay before 2018, which made it an OEM payment method. But Samsung Pay is also an OEM payment method, even though it uses Android technology.

Confusing, right? Don’t worry, by the end of this blog you’ll know the difference between OEM Pay and Issuer Pay, and why it’s important to offer both payment methods to your customers.

So, what's the real difference between these payment services? Well, it all comes down to integration, how many payments they can handle and the user experience they offer.

OEM payment methods, like Apple Pay and Google Pay, are built right into your phone and usually use Near Field Communication (NFC) technology for those quick contactless payments. Samsung Pay is unique though because it uses Magnetic Secure Transmission (MST), which mimics the magnetic swipe technology you find on payment terminals.

Compared to Issuer payment methods, OEM Pay has more control over the phone's NFC on both iOS and Android devices right now. They can store multiple digitised payment cards for consumers, but the downside is that they may lack a unique and branded experience for customers.

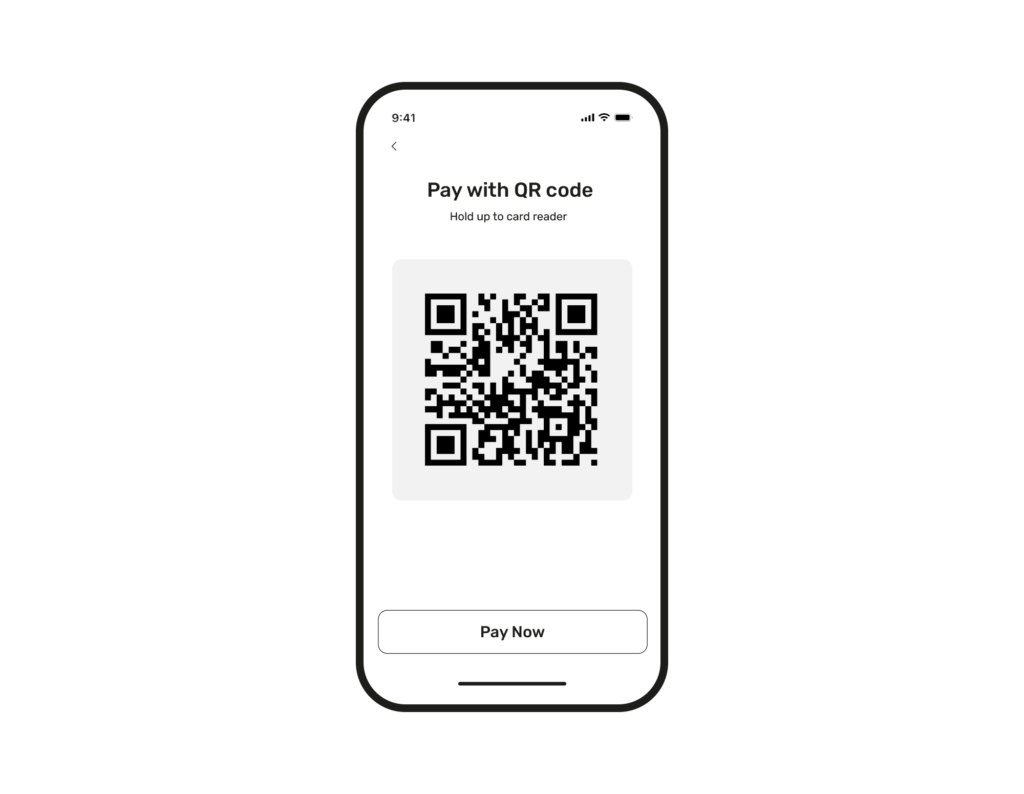

On the other hand, Issuer payment methods, like Alipay, belong to specific brands. They face some limitations on iOS devices, which means they often use QR codes and barcodes instead of NFC for payments. The exception here is Mastercard's MasterPass wallet, which can still use NFC on iOS devices.

Issuer Pay apps, in a more localised sense, usually focus on just one payment type. However, they often provide a more immersive experience with branding and connections to cross-selling schemes that serve multiple purposes.

Why not check out which OEM and Issuer Pay methods you can accept via our platform.

Now, let's talk about what makes a payment truly contactless. Typically, it means a quick "tap and go" method using NFC or MST technology. OEM apps, like Apple Pay, have the advantage here, as they can directly communicate with the native NFC technology on your device. So, you don't even need to open the app to make a payment.

However, Issuer Pay apps often require you to open the app and present a barcode or QR code to a scanner, which can be a bit more tricky, especially when it comes to self-service scanners. So, can it really be classed as contactless?

But here's the interesting part; in Asia, contactless payments took off sooner and faster, with QR code readers becoming popular for self-service payments well before they did in the West. In fact, in China, 70% of mobile payments are currently made through self-service QR code readers. So, arguably this payment method instigated the movement for contactless payments.

Issuer Pay wallets do also have their own advantages, especially when it comes to catering to tourists and international markets; due to their customisable branding, they can offer cross-channel marketing and loyalty schemes to reward customers.

However, for a truly frictionless experience, Apple Pay and Android Pay are leading the way, both online and at the point of sale. Even with Asia's preference for QR codes, global NFC facilitation is on the horizon.

At the end of the day, the whole idea behind e-wallets and contactless payments is to make payments easier and faster.

In Asian markets, e-wallets with QR code capabilities have been preferred for quite some time, even before NFC became popular in the West in 2008. But now, Apple Wallets is creeping up with a 52% share of OEM payments, which is expected to grow, especially as NFC technology starts to take over some of the QR code market. Huawei is also joining the likes of Alipay and WeChat Pay in offering a global payments service.

While AliPay's success in China is undeniable, Apple Pay's global success is even bigger. It's estimated that by 2024, Apple Pay will account for 10% of all card payments worldwide, both online and at point-of-sale.

Right now things are looking pretty bright for OEM Pay. Apple, Google and Samsung Pay are leading the way, with millions of users jumping on board. People love the convenience of digital wallets, and contactless payments are skyrocketing with a 95% increase in the West.

More and more folks are ditching physical cards and choosing to use their phones for payments. In the UK, 42% of millennials prefer the ease of paying with their phones.

OEM Pay makes life simpler by consolidating all your cards in one place. You get to pick your favourite payment method and enjoy seamless omnichannel payments with Apple and Google Pay. On the other hand, Issuer pay, while branded, often has fewer options available, limited by the brand's scope and region.

The rise of open banking regulations is also increasing the value of both OEM and Issuer Pay apps, giving consumers more choices in how they pay, not just who they pay with.

And looking ahead, the scope of what Issuer Pay applications can offer is only going to broaden. Take MasterPass, for example, which can accept schemes from major card providers like AMEX and Visa, even though it's mainly affiliated with Mastercard.

The future is looking promising! By 2020, contactless payments are expected to make up a third of all global transactions. OEM payments alone will be worth a staggering $300 billion USD in in-store contactless transactions, accounting for 15% of all transactions. And guess what? Apple Pay will be responsible for half of those!

New players are also joining the game, like Huawei Pay and Fitbit Pay, adding even more choices for users.

Even though new payment regulations are evening the playing field, OEM Pay still has an edge with its proprietary assets, giving brands like Apple and Google a head start in the payments space. As they continue to grow, NFC technology will become even more essential, especially in Asia, where these big players have a strong influence.

So, get ready for a future where phones become the ultimate payment buddy! It's all about convenience and ease, and OEM Pay is leading the way.

Should popular Asian wallets, such as AliPay, facilitate NFC or MST technology if Apple lifts its proprietary hold? Right now, Apple has a stronghold with its NFC technology, but if that changes, it could open up new possibilities for other payment methods.

If AliPay were to adopt NFC or MST technology, it could offer even more convenience to its users, making contactless payments easier and faster. Other Issuer wallets might also consider a shift towards "blind payments," where users can make payments without opening the app or scanning a barcode. This could further streamline the payment process, but they might have to sacrifice some cross-channel marketing opportunities.

There's also the idea of combining OEM Pay and Issuer payments. This could bring the best of both worlds, providing a wide range of payment options and consolidating all cards in one place. It's worth considering whether Issuer Pay will stay exclusive to their own services or embrace OEM Pay apps for the sake of consumer convenience and retention.

As Apple Pay continues to dominate the future of payments, it's essential for other payment services to stay adaptable and innovative. The landscape is always changing, and finding the right balance between convenience, security and user experience will be key to the success of any payment method. Exciting times are ahead for the world of digital payments!

As you can see, in today’s market, it’s essential to accept alternative payment methods to keep up with consumer demand. To learn more about which payment methods you should accept in your region and industry, and how you can integrate them into your checkout, get in touch with a specialist today!