In the ever-evolving landscape of finance, it's crucial for businesses like yours to stay informed about the tools and systems available. One major shift in recent years is the move towards open banking. But what does that mean for you, and how does it differ from traditional payment methods?

Before we start, let’s define what open banking is and what we mean by traditional payment methods.

Open banking is the latest development in the financial world. It’s simplifying the way consumers send and manage their funds through the use of real-time payments where the funds are transferred directly from the customer’s account to the merchant. It also utilises shared financial data with third parties so they can receive personalised recommendations from the services they use.

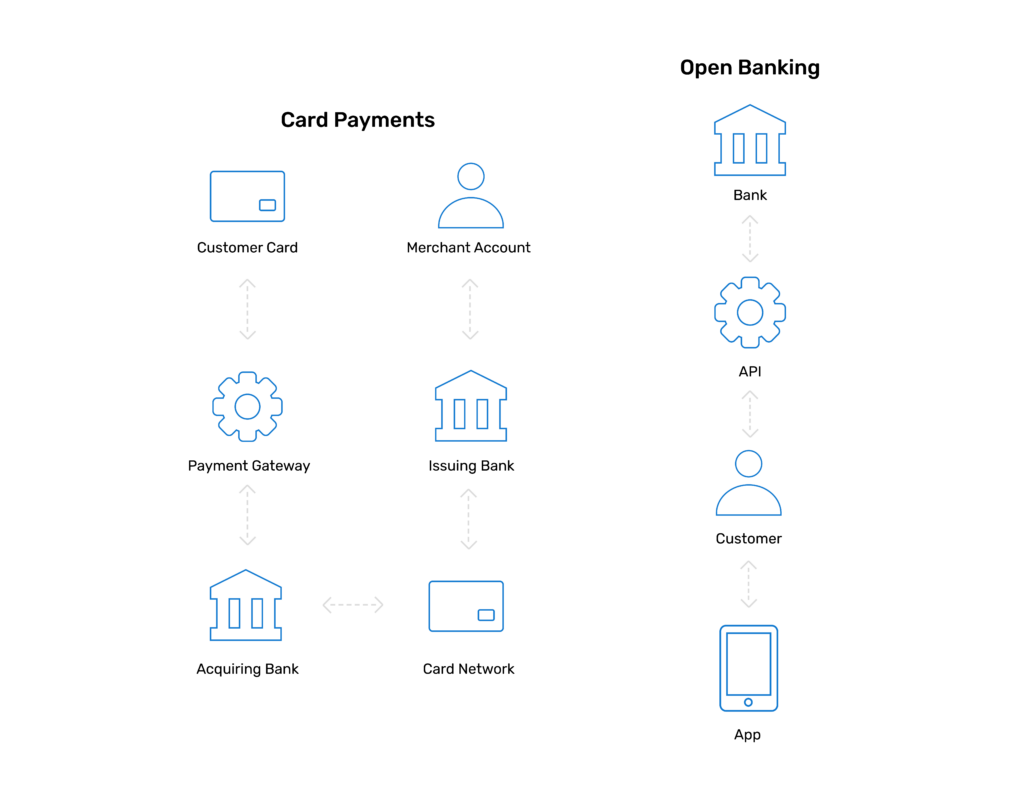

Whereas traditional payment methods, like card payments, include multiple agencies such as the card network, acquiring banks and payment gateway providers, etc. It’s often just a payment too without any additional services that open banking can provide.

Let's take a look at the key capabilities of both and how they differ.

Traditional payment methods: Within traditional payment methods, access to financial data is limited. The customer’s bank holds all the information, making it difficult for other financial institutions or merchants to access it.

Open banking: The best part about open banking is that it allows third-party financial service providers to access a consumer’s financial data (with their permission, of course). This means a variety of apps and services get a real-time view of their financial health, helping them make informed decisions.

Traditional payment methods: Transactions through traditional payment methods can have slow processing times and increased costs due to additional fees, including scheme fees. They may also not be the consumer's preferred payment method, making them less convenient.

Open banking: With open banking, transactions can be quicker and more cost-effective. The use of APIs (Application Programming Interfaces) allows for seamless integration between different financial systems, making transactions faster and more efficient.

Traditional payment methods: These methods may lag in adopting new technologies and providing personalised services. The services offered are typically dictated by the financial institution.

Open banking: The beauty of open banking lies in its ability to foster innovation. Third-party developers can create applications that cater specifically to a customer’s needs, offering a level of customisation and innovation that traditional methods often struggle to match.

Traditional payment methods: Traditional payment methods implement robust security measures, including strong customer authentication (SCA) such as a PIN or facial recognition, yet the threat of fraud and cyberattacks persists.

Open banking: Security is a top priority in the open banking ecosystem. The consumer has more control over which services can access their financial data because they must give consent before it can be shared, enhancing overall security.

Traditional payment methods: Cross-border transactions through traditional methods may involve multiple agents, leading to prolonged processing times and higher fees. But with the use of local acquirers, you can combat these challenges and increase your approval rate.

Open banking: Open banking facilitates cross-border payments with greater speed and cost-efficiency. Real-time access to international financial networks allows for swift and secure transactions, reducing the complexities associated with traditional cross-border payments.

Now, let’s take a look at the most popular traditional payment methods in comparison to open banking.

When you make payments with cards, you need an extra step using a third-party gateway and the card network, adding more fees, longer processing times and potential security risks. But with real-time payments via open banking, the transactions are completed instantly. Businesses pay less in fees compared to credit card processing, and they get their money faster with instant confirmation.

Card payments are accepted worldwide, but open banking, with it being a new innovation, is not quite there yet. Not all financial institutions have adopted this payment technology, so it’s still very important that you accept both.

Direct Debits and recurring payments are hugely popular when it comes to those monthly bills. The automated functionality makes them easy and convenient.

However, open banking is coming through with variable recurring payments (VRP). They both require the customer to authenticate the first payment making them just as secure as the other.

Since VRP is an up-and-coming method and one that may still need implementation for some financial institutions as well as merchants, consumers may not trust it as much as the old-faithful Direct Debit.

Although there are a lot of perks to open banking and we believe it’s definitely a method you should consider offering, it’s still important to offer traditional payment methods too. New technologies take time to be fully adopted and gain customer trust, and of course, everyone has their own preference on which method to use, so providing both is key to keeping your customers happy.