One business strategy that has gained significant traction in recent years is the subscription-based business model. From streaming services to meal kits to software-as-a-service (SaaS) platforms, it’s safe to say that subscriptions have taken over and are transforming the way consumers access products and services. Over the past nine years, the subscription economy has grown by 435% and will continue to grow with projections to reach a massive $1.5 Trillion by 2025!

But is a subscription-based business model the right fit for your company? Before diving headfirst into this type of recurring payment, it's crucial to carefully evaluate whether it aligns with your business goals, offerings and target market. In this blog, we'll explore the key considerations to help you determine whether a subscription payment solution is a strategic fit for your business.

What’s in this article?

Let’s begin with the basics. A subscription-based business model is a type of recurring revenue model where customers pay a regular fee at set intervals, typically monthly or annually, in exchange for ongoing access to a product or service.

Unlike traditional one-time purchases, these models focus on customer loyalty to keep them around long-term. Thanks to its convenience for customers and predictability for merchants, it has gained huge popularity in a range of different industries, including e-commerce, entertainment and SaaS.

There are numerous benefits associated with adopting subscription billing, so before you consider whether it is suitable for your business, let’s see what you’ll get out of it:

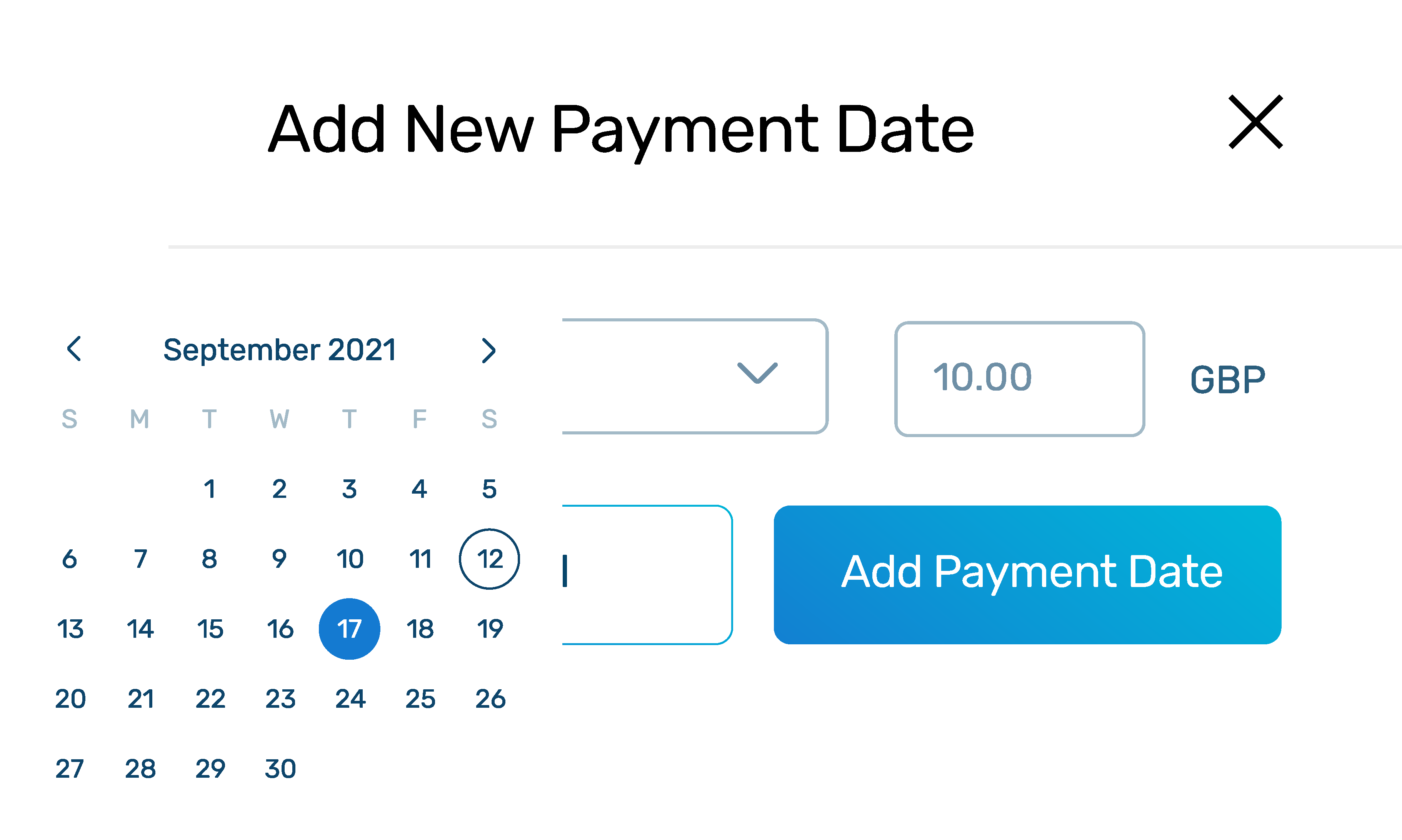

Subscription billing software automates recurring payments, manages subscriber accounts and tracks billing metrics. It helps businesses set flexible pricing and handle subscription changes like upgrades, payment breaks or cancellations smoothly.

To fully understand how it works, we’ve covered how to accept subscription payments and then how to manage them.

To accept recurring payments online, you'll need a subscription payment gateway integrated into your website. A payment gateway suitable for subscriptions will securely process recurring transactions, encrypt sensitive payment information and ensure compliance with industry regulations, such as PCI DSS (Payment Card Industry Data Security Standard).

Here's how to get started:

Once you’re all set up to accept subscription payments, next is knowing how to manage them to ensure smooth operations and maximise revenue. Here are some best practices for managing subscription billing:

For more tips, you can check out our blog on managing recurring payments.

Now you have all the information on what a subscription-based business model entails and how to take subscription payments, it’s time to evaluate your own business model to see if it could be a beneficial option for you.

Understanding your customer base

What do your customers need or want? What keeps them coming back for more? The success of a subscription model hinges on having a loyal customer base that values recurring access to your products or services. Consider whether your offerings lend themselves to ongoing usage, and if they do, whether your customers will benefit from the convenience of subscription-based access.

Product or service viability

What do your customers need or want? What keeps them coming back for more? The success of a subscription model hinges on having a loyal customer base that values recurring access to your products or services. Consider whether your offerings lend themselves to ongoing usage, and if they do, whether your customers will benefit from the convenience of a subscription platform.

Revenue predictability and stability

Subscription models offer the advantage of predictable revenue streams, which can be appealing to businesses seeking stability and steady growth. However, it's essential to weigh this against the potential challenges of acquiring and retaining subscribers, as well as managing churn rates.

Customer acquisition and retention costs

Although trying to gain new customers can work out more expensive than retaining current ones, building and maintaining a subscriber base can also require investments in marketing, customer acquisition and retention efforts. It’s important to evaluate the upfront costs associated with acquiring subscribers and whether you have strategies in place to minimise churn and maximise customer lifetime value.

Flexibility and scalability

One of the benefits of subscription models is their flexibility and scalability. They allow you to experiment with pricing, packaging and features to optimise value for your customers. Assess whether your business can adapt to changing market demands and scale its subscription offerings accordingly.

Operational considerations

Implementing this payment model can involve operational adjustments, including subscription billing systems, customer support infrastructure and subscription management processes. Ensure that your business has the resources and capabilities to effectively manage these operational aspects.

Competitive landscape

Are your competitors utilising subscription payments? To remain relevant within your industry, determine whether a subscription-based model sets you apart and addresses unmet customer needs. Consider how your offerings differentiate from existing subscription services and whether you can carve out a unique value proposition.

Although it’s important to consider whether a subscription billing system is right for your business model, its’ safe to say there are so many benefits in implementing one.

If your business is ready to embrace subscription payments, we have the recurring payment solutions to help. Check out our payment offering, reconciliation tools and reporting dashboard, or have a chat with one of our experts to see what we can do for you.