The subscription-based economy is already a considerably popular market with the rise of Netflix, Spotify, Audible, Hello Fresh and Disney Plus subscriptions. It’s rare to find someone who doesn’t have at least one subscription set up these days. In fact, pymnts.com conducted a case study that found 64% of millennials have at least one of these services or share someone else’s account, and 78% of all consumers subscribed to at least one service – up 6% from 2019. Think about how many you have yourself!

Before we discuss why this rise has come about, first let’s recap what a subscription economy is.

What's in this article?

The subscription business model is part of a broader range of recurrence-based payment models. These types of services tend to be used, and paid for, weekly, monthly or yearly. In short, it is a service that is used repeatedly.

The subscription-based economy highlights the growth of this particular business model. You’ll notice that the majority of the businesses mentioned above are from the entertainment sector, so, it’s fair to say that these kinds of services are often thought of when we talk about subscriptions.

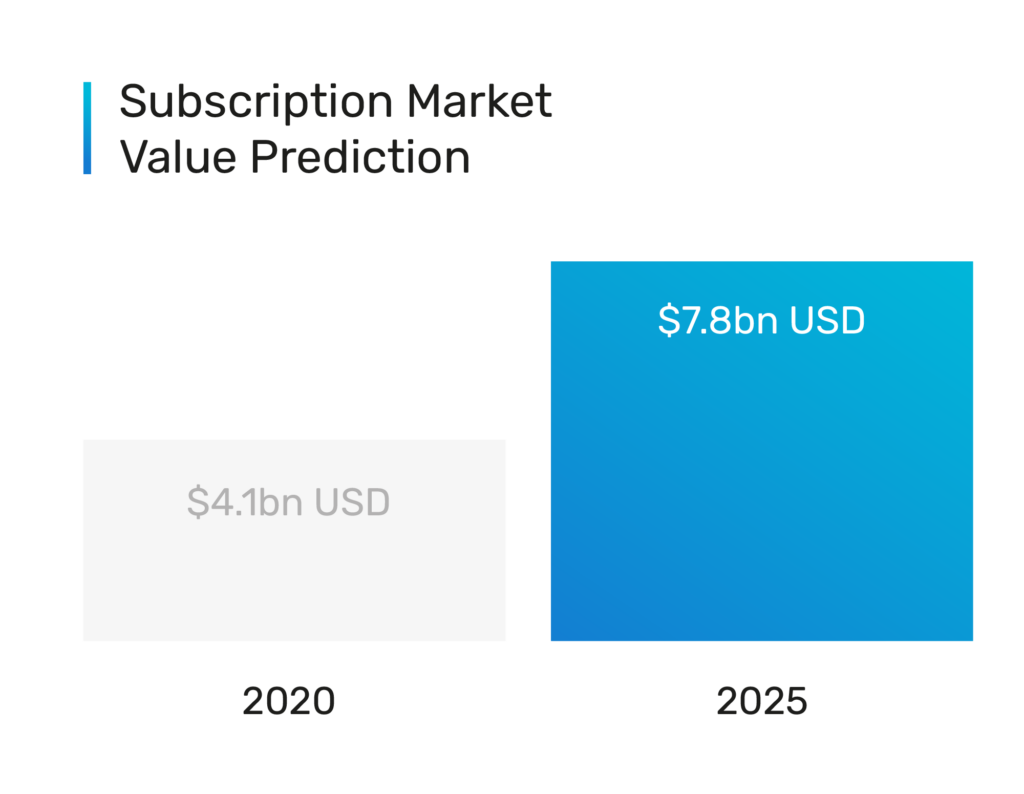

Lockdown was the time for subscriptions to really shine; it gave them the chance to truly demonstrate their value. However, with the increase in the amount of entertainment subscription businesses, alongside repayment models often used with IVA and debt management, it’s no wonder that even prior to lockdown, the subscription economy was already growing with a market value set to increase from $4.1bn USD in 2020 to $7.8bn by 2025.

Since consumers were left with little choice but to buy subscription services to replace what they’d usually purchase in-store; merchants had to adapt their businesses to be more like a recurrence-based model. Even new sectors turned to subscription models to generate the retention and customer trust that they once achieved through an in-store experience.

For example, 59.7% of surveyed vacationers said that they would be willing to book more trips if flexible repayments or recurring payment options were made available.

The subscribe and save economy has also been on the rise. This new tactic to encourage sign-ups is an attractive option, especially to millennials, giving them the flexibility to manage their finances through installments and versatility.

On average, the UK consumer will spend £60 a year on subscription services, but, to continue the upward trajectory of the subscription economy growth rate, those that fall into broader spectrums of recurring-billing models, such as debt management, can still learn from the success of the more popular entertainment services.

In exploring customer churn and retention, the infrastructure of recurrence-based models, regardless of their use case, paints a picture of the changing consumer behaviour and the need for convenience in an increasingly competitive market.

If you’re looking to scale your subscription business and adapt to match customer demand, offering a customisable package is key. The more you focus on a user-centric model, the greater the chance to increase your monthly recurring revenue. The more revenue you retain, the more able you are to adapt to use even more automation, reducing churn further through effectiveness and efficiency.

But let’s take a further look into churn…

There are many reasons why a customer can no longer make a payment or choose to cancel a subscription, and they can fall under two categories: involuntary and voluntary churn.

As studies reveal that 55% of retailers say subscription models increase customer retention and loyalty, it’s clear that an automated service can be successful in decreasing churn. But, that doesn’t mean it still can’t happen. The service still needs to be seamless and convenient since 7.3% of subscribers plan to cancel their plans within the first year. That’s why the level of this automation can help to reduce cancellation risks and friction in all forms of recurrence-based payments.

Here are the main reasons why a subscription-based model could lose a customer under each category:

Payments declined due to:

Since subscription services are on the rise, so will your competition. To stay on top of the market, it’s pretty clear that the biggest advantage your service should provide is customisation. Things change, including finances, situations, priorities, etc., and to ensure you minimise the risk of churn, you as the merchant need to be aware of this.

For example, in order to further help consumers manage their service, repayment amounts should be tailored and added on an individual basis to suit flexible and ever-changing circumstances. 51.7% of customers profiled by pymnts.com – amounting to 14.2 million consumers – would pause a subscription service over cancelling it when given the option.

That’s why we cater to the demands of both merchants and consumers through the dynamic functionalities of our recurring payment tools.

Here are just some of the features we can provide to offer the best ways to accept recurring payments:

Want to know more about how you can scale your subscription business? Get in touch today to learn more about our recurring payment solutions!