Looking for ways to increase your recurring revenue? Why wouldn’t you be? Recurring revenue is essential for sustained growth and success. Whether you're a subscription-based service, an e-commerce platform or a SaaS provider, optimising your payment reconciliation process is key to unlocking the full potential of your business.

In this guide, we'll explore how you can enhance your recurring revenue flows and streamline your online payment reconciliation with key tools and strategies.

What’s in this article:

So, without further ado, let’s get straight to it with our top tips on how to increase your recurring revenue.

Conduct thorough market research to ensure your pricing plans are competitive yet profitable. Consider offering tiered pricing options to cater to different customer segments and maximise revenue potential.

You could go one step further and utilise dynamic pricing strategies to adjust subscription fees based on factors such as usage, demand or customer behaviour. Dynamic pricing algorithms can help optimise revenue by automatically adjusting prices to maximise conversions and revenue.

32% of customers will stop shopping with a brand after a single bad experience, so it’s important to focus on delivering exceptional customer experiences to increase loyalty and reduce churn. For example, you can implement loyalty programs, offer personalised recommendations and provide proactive customer support to build long-term relationships.

Most importantly, be flexible with payments. You’d much rather have a customer pause their subscription than cancel it altogether. If you can offer them the freedom to alter their plan, including the date they pay or the amount they pay, you’re much more likely to retain their custom.

If you want to appeal to a wider audience, diversify your product or services to increase upsell and cross-sell opportunities. Continuously innovate and introduce new features or packages to encourage existing customers to upgrade their subscriptions.

Managing failed payments is a critical aspect of optimising recurring revenue streams. Despite best efforts, failed payments can still occur due to a number of reasons such as insufficient funds, expired credit cards or technical issues. Effectively handling failed payments can help minimise revenue loss and improve customer satisfaction. Keep reading for tips on how to combat this.

The most important tip is to have a payment reconciliation process in place to increase your collection rates. At Total Processing, we offer an array of payment collection tools designed to prevent late or missed payments and maximise recurring revenue. So say goodbye to manual tasks with our automated reconciliation features:

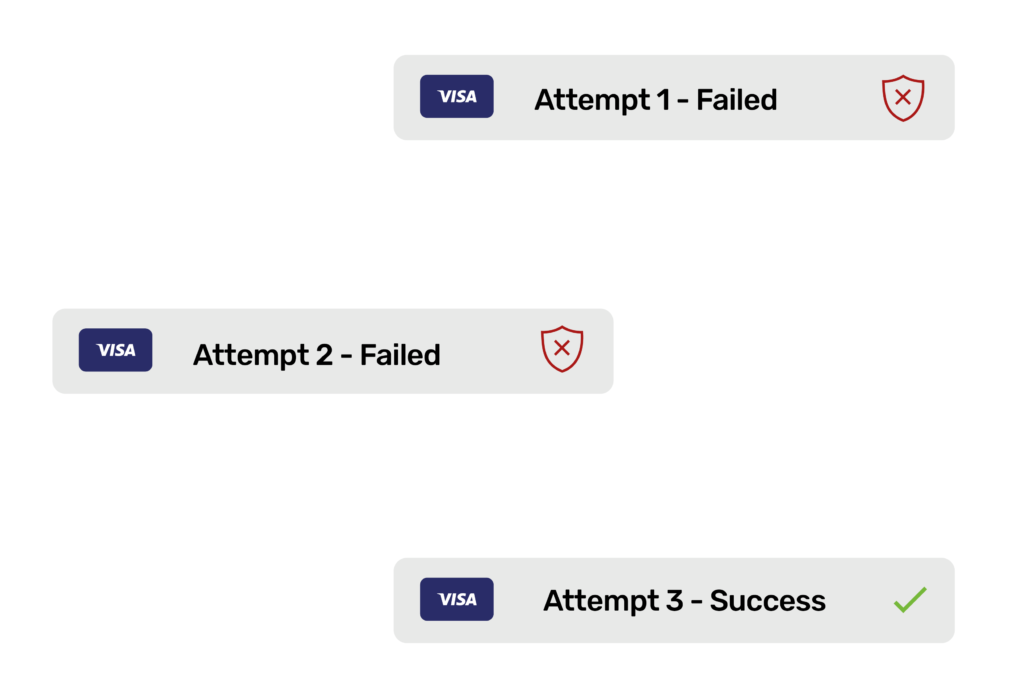

Auto rebiller - If a payment fails first time, the auto rebiller is a handy tool that will keep trying until the payment is successful. Sometimes there's a limit on how many times it can try, which is when you can send pay by links instead.

Multi-card registration: With this setup, if the default card expires, the system will automatically attempt alternative registered cards until a successful payment is processed, reducing churn significantly.

Pay by links: If a payment has been missed, you can send a gentle reminder via SMS or email in the form of a payment link. This allows the customer to easily make the payment at their earliest convenience. You could even send them when they are due to avoid the payment being late at all.

Account updater: Cards expire or get lost, but there’s no reason why this should affect you getting paid. Our account updater uses information provided by the card scheme networks to ensure your customer’s details are always up to date with the latest card information.

Optimal billing times: With valuable insights into your payment data, helping you to track key performance metrics and identify trends, our intuitive dashboard can help you make data-driven decisions, such as when the best time is to take the payment to increase the chance of success.

Maximising recurring revenue requires a strategic approach to pricing, customer retention and payment reconciliation. By leveraging advanced tools and techniques, such as Total Processing's automated payment reconciliation software, businesses can streamline their operations, reduce costs and unlock the full potential of their recurring revenue streams. Invest in the right tools today and pave the way for sustainable growth and success tomorrow.