Chargebacks are an unavoidable yet detrimental part of doing business, and understanding them is crucial for maintaining a healthy bottom line and a positive reputation. In this blog, we'll take a look at the most frequently asked questions on the topic to break down what chargebacks are and how you can navigate the often-tricky waters of these transaction disputes.

A chargeback occurs when a customer disputes a credit card transaction and the funds from that transaction are returned to the customer. The responsibility to prove the legitimacy of the transaction falls squarely on the merchant's shoulders. Chargebacks can happen for various reasons, including fraud, billing errors, product dissatisfaction or unauthorised transactions.

Chargebacks can also be known as friendly fraud because, more often than not, a customer is making a claim with no legitimate reason to do so (other than being angry and impatient to get their money back), and without realising this is a type of fraud. That being said, a study discovered that 23% of consumers admitted to disputing purchases even though they received the item and were satisfied!

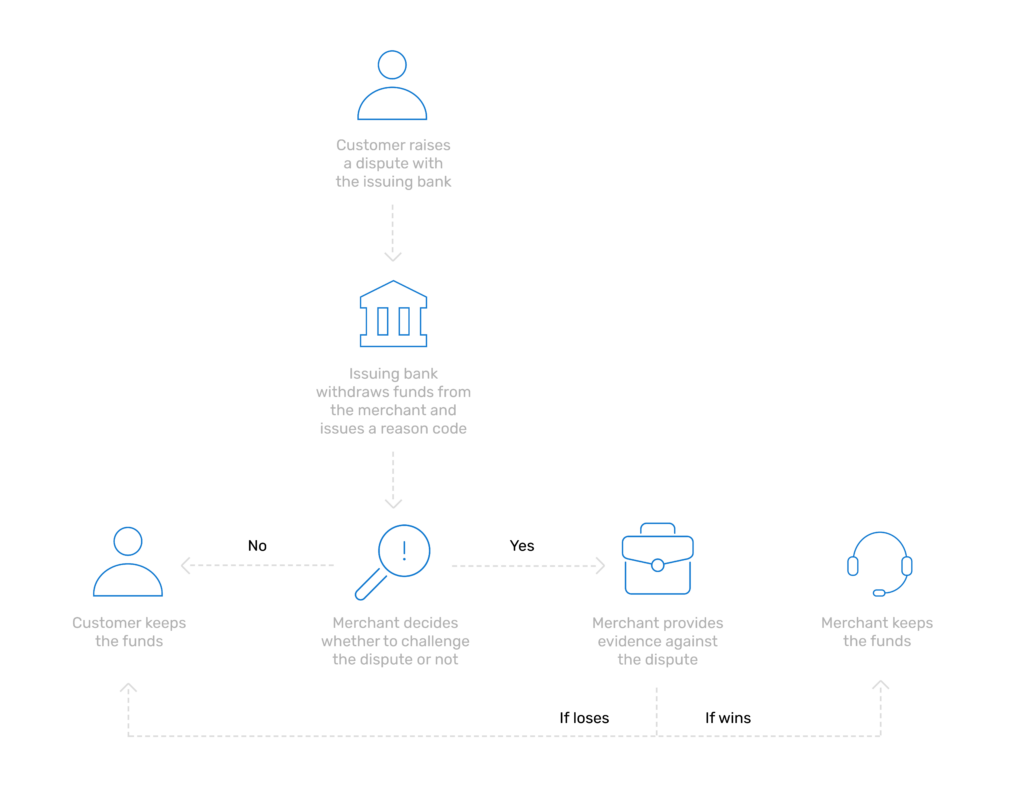

When a customer initiates a chargeback, their card issuer investigates the claim. As a merchant, you're required to provide evidence to support the transaction's validity.

If you fail to do so, you lose both the sale and potentially incur chargeback fees and penalties. Not only that, but excessive chargebacks can result in higher processing fees or, in severe cases, losing your ability to accept credit card payments.

Chargebacks can take a toll on your business. They directly impact your revenue and, indirectly, your reputation. The fees and penalties associated with chargebacks can quickly add up, affecting your profitability. A high chargeback ratio may even raise a red flag with your payment processor or acquiring bank.

That’s why it’s so beneficial to have tools in place to keep your chargebacks at a minimum, such as chargeback alerts.

If you believe a chargeback has been unjustly initiated, you have the right to dispute it. Gather all relevant documentation, such as receipts, proof of delivery, communication records and any other evidence supporting the legitimacy of the transaction. Present a compelling case to your payment processor, and be prepared for the possibility of a chargeback arbitration process.

Credit card chargebacks are accompanied by reason codes that categorise the cause of the dispute. Card schemes, like Visa and Mastercard, have their own codes for you to be aware of, however, common reason codes include "fraudulent transaction", "goods not as described" and "services not rendered". Understanding these codes is crucial for addressing the root causes and taking proactive steps to prevent recurring issues.

Prevention is the best defence against chargebacks. Here are some proactive steps you can take:

Chargebacks are a challenge that all merchants face, but they can be managed and minimised. By understanding how chargebacks work, actively working to prevent them and being prepared to dispute unjust claims, you can protect your business and maintain a strong reputation in the market. So, when it comes to chargebacks, knowledge is your best ally.