Open banking has revolutionised how financial data is shared, unlocking a world of possibilities for you and your customers.

This financial innovation has already reached big numbers – Globally, volumes are projected to grow from $53 million in 2023 to $334 billion in 2027.

But what is open banking and how could it benefit your business? Let’s take a look…

The goal of open banking is to make it easier for data to be shared amongst third parties, improving the experience of financial tasks, such as payments, transactions, investments, etc. It’s a system that allows banks and other financial institutions to securely share a customer’s financial information with other financial providers, which would otherwise be kept in-house.

But what does this mean for all those affected?

Whether it’s a bank or a payment processing service, the financial institution can easily share its customer’s data to businesses, offering a more frictionless and trusting service.

Businesses can really benefit from open banking. With more access to a customer’s data, they can promote their business more effectively, as well as automate instant payments for a seamless experience.

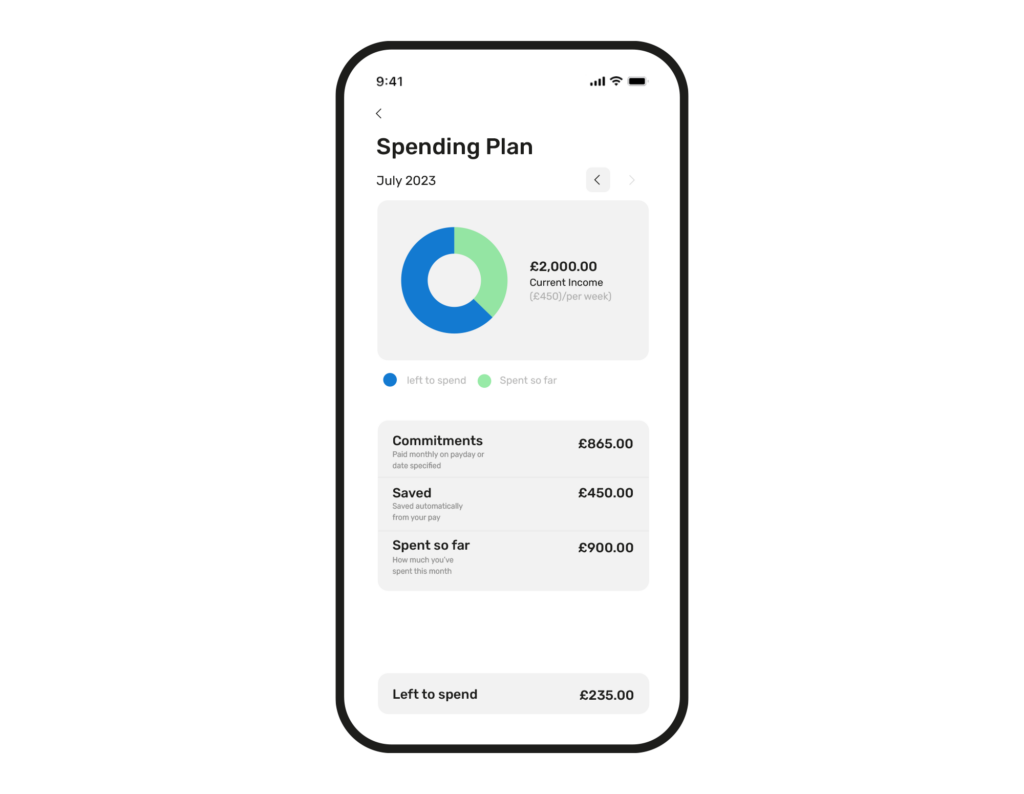

Open banking puts the customer in control of their financial data. They can choose who has permission to access it and enables them to manage all of their accounts in one place, giving them better financial management, personalised recommendations and innovative products. It's like having a digital hub for your finances to make smarter money decisions.

Imagine having several accounts with different banks and financial services. In the past, it was a bit of a hassle to keep track of all your balances, transactions and expenses. Open banking changes that game!

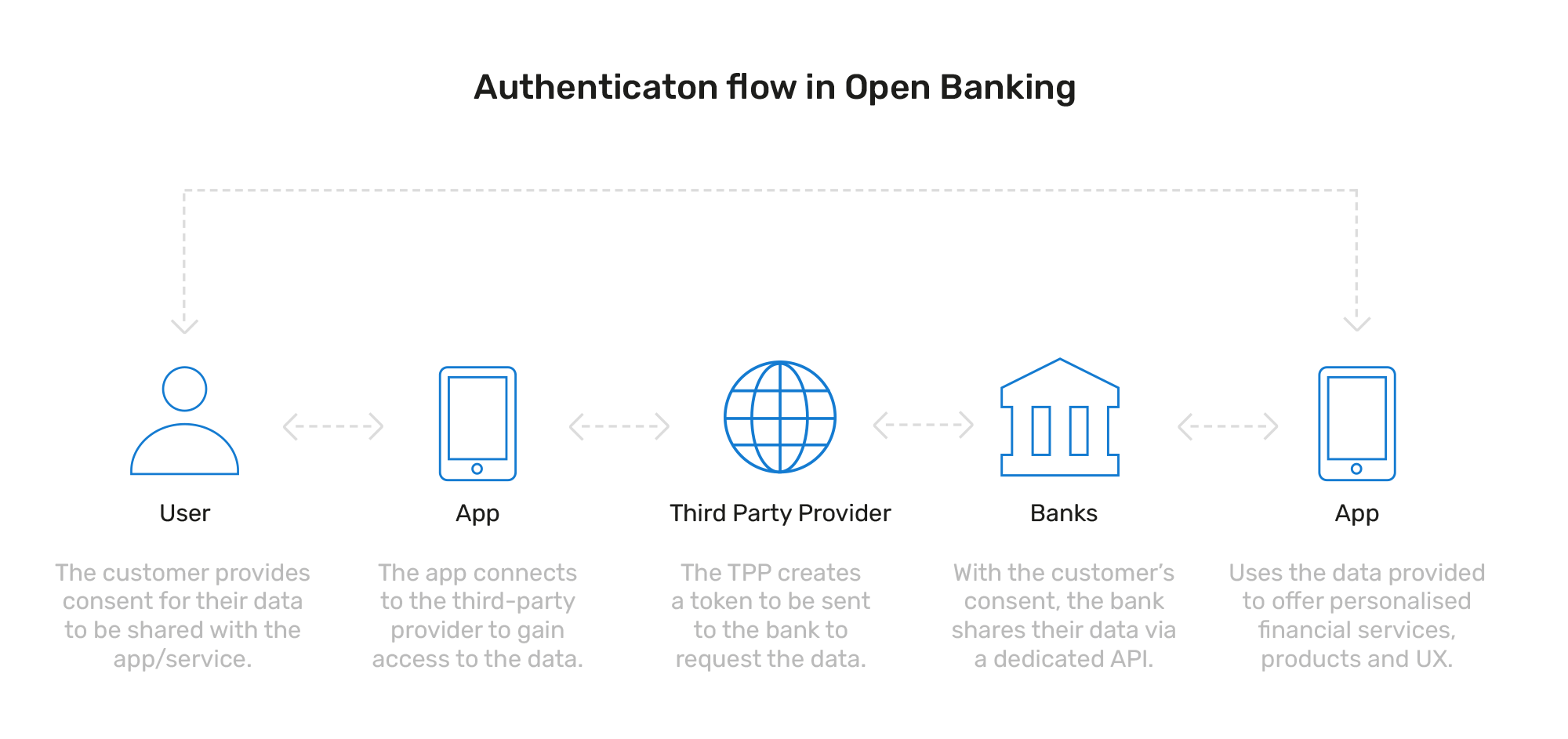

Time to get a bit more technical. Open banking is enabled by Application Programming Interfaces (API); essentially a gateway between different software to help them speak to each other.

Open banking API is basically a set of instructions on how third parties can access a person’s data, such as account name and transaction history. The customer doesn’t need to fill out any lengthy forms; the third-party website will be able to access the data directly.

It’s down to the financial institution to implement open banking into its offering so that its merchants, and then ultimately the merchant’s customers, can benefit from it.

There are multiple scenarios in which open banking can be used to the benefit of all those involved. Let’s take a look at how to use open banking.

Since more businesses and services are gaining access to someone’s financial information, it’s completely valid to wonder whether open banking is safe. The short answer is yes!

Just like any other type of digital financial service, open banking puts a high priority on keeping financial information safe and secure.

Firstly, data sharing can only take place with the customer’s permission. They have full control over which third-party apps or services will gain access to their data and can revoke it at any time.

Secondly, access to APIs is safeguarded by strict banking industry standards such as PSD2. And since open banking relies on API to transmit the data, the information is protected in the same way online banking is. Therefore, there are open banking regulations that banks and financial institutions must follow, including encryption and authentication protocols, to keep the information confidential.

Of course, it's always important to choose trustworthy and reputable apps or platforms when using open banking. But when using a reputable service, open banking is designed with your security in mind.

Open banking and open finance may sound similar, but they have some differences. Open banking is all about sharing financial data between banks and other trusted companies. It allows you to connect your bank accounts to other services, like budgeting apps or loan platforms to help them manage their finances more easily.

Now, open finance takes things a step further. Think beyond just banks - It covers sharing data from various financial sectors, such as insurance companies, investment platforms and more. It’s like having a complete birds-eye view into someone’s financial life, rather than just a peek.

In simpler terms, while open banking focuses on bank-related data sharing, open finance expands that scope to include a wider range of financial information for a more comprehensive financial picture.

If you’re looking for open banking UK providers, we’ve got the solution for you. We’ve partnered with Token.io, the leading provider of account-to-account (A2A) payments enabled by open banking. This partnership allows us to leverage their extensive connectivity network and slick platform to offer you a fast and efficient way to launch Pay by Bank as a core payment method.

To implement your open banking payment solution, get in touch with one of our specialists today.